Analyst Predictions Suggest Significant Growth for QTEC ETF

In a recent analysis of the First Trust NASDAQ-100-Technology Sector Index Fund ETF (Symbol: QTEC), we examined its holdings’ trading prices alongside expected future values from analysts. This evaluation revealed that the implied target price for QTEC is $225.40 per unit, while it currently trades at about $198.26.

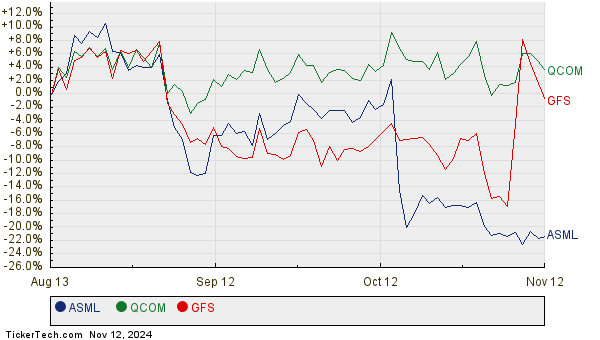

This disparity indicates a potential upside of 13.69% for QTEC when considering the average analyst projections for the underlying stocks. Notable contributors to this outlook include ASML Holding NV (Symbol: ASML), Qualcomm Inc (Symbol: QCOM), and GlobalFoundries Inc (Symbol: GFS). Despite ASML’s current share price of $671.31, analysts anticipate a higher average target of $908.38, suggesting a 35.31% increase. Meanwhile, Qualcomm’s recent price of $168.29 has a target estimate of $210.29, which translates to a promising 24.96% upside. Analysts also project GFS will rise to a target price of $51.92, marking a possible 21.59% increase from its recent value of $42.70. Below is a twelve-month price history chart for ASML, QCOM, and GFS:

Together, ASML, QCOM, and GFS account for 6.43% of the QTEC ETF. Below is a summary table detailing current analyst price targets:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust NASDAQ-100-Technology Sector Index Fund ETF | QTEC | $198.26 | $225.40 | 13.69% |

| ASML Holding NV | ASML | $671.31 | $908.38 | 35.31% |

| Qualcomm Inc | QCOM | $168.29 | $210.29 | 24.96% |

| GlobalFoundries Inc | GFS | $42.70 | $51.92 | 21.59% |

As we consider these predictions, an important question arises: Are these targets realistic, or do they reflect an overly optimistic view of the market? Analysts must stay agile to account for shifting conditions in both company performance and broader industry dynamics. A high target price could indicate strong future potential but might also suggest that analysts need to reassess their outlook based on the latest developments. Investors should conduct their research before making decisions based on these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

– PV Split History

– IIPR shares outstanding history

– FMC MACD

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.