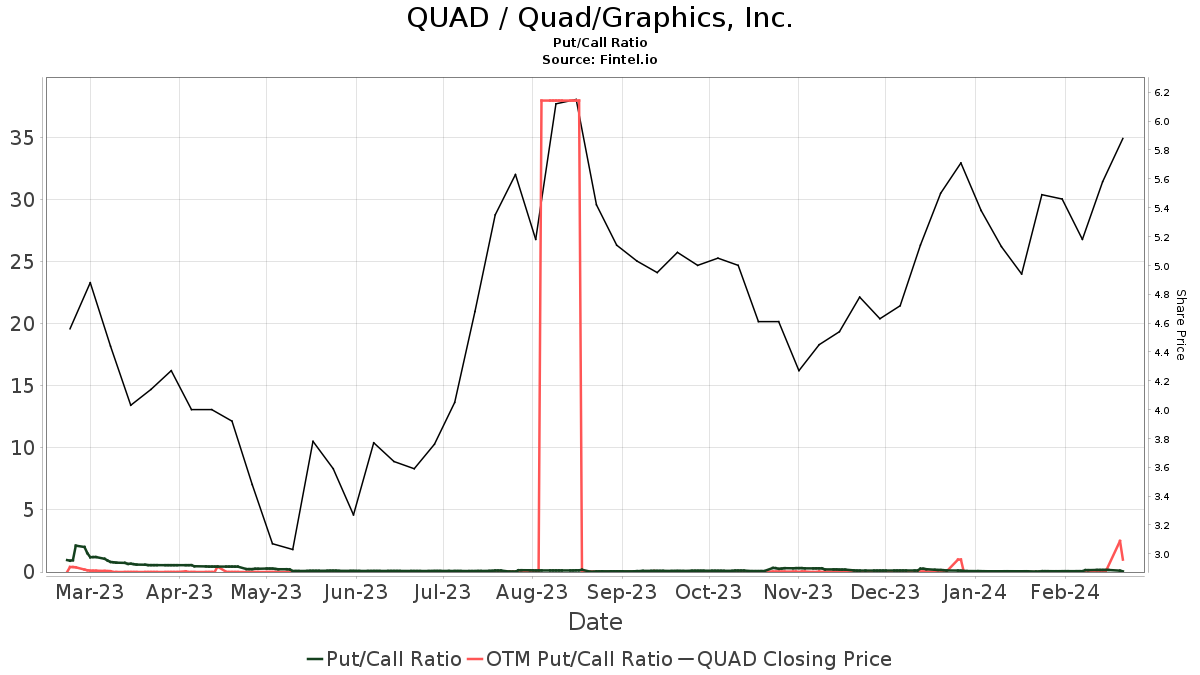

Quad’s Steady Dividend Decline

Quad, a veteran in the marketing solutions industry, recently announced a regular quarterly dividend of $0.05 per share ($0.20 annualized), a significant drop from its previous $0.15 per share dividend. Shareholders of record as of February 27, 2024, are slated to receive the payment on March 12, 2024.

Historical Dividend Yields

Over the past five years, Quad’s dividend yields have fluctuated, with an average of 9.51% and a standard deviation of 5.78%. The current yield of 3.75% marks a deviation of 1.00 standard deviations below the historical average, painting a picture of the company’s changing financial landscape.

The Fund Sentiment and Ownership

With 243 funds or institutions now owning positions in Quad, there has been a 1.25% increase in ownership in the last quarter. The average portfolio weight dedicated to Quad stands at 0.04%, with total shares owned by institutions rising to 21,107K.

Analyst Price Forecasts and Revenue Projections

Analysts are projecting a 52.81% increase in Quad’s stock price, with an average one-year price target of 8.16. Additionally, the company’s projected annual revenue is expected to rise by 8.80%, with a non-GAAP EPS of 0.95.

Insight into Shareholder Activities

Several prominent firms have adjusted their holdings in Quad. Hotchkis & Wiley Capital Management raised its ownership to 3.19%, while Miller Value Partners and Lsv Asset Management saw both increases and decreases in their portfolio allocations. Renaissance Technologies displayed a decrease in their position by 3.54%.

A Glimpse into Quad’s Background

Quad, positioning itself as a global marketing solutions partner, boasts a 50-year track record of excellence and innovation. The company’s integrated marketing platform aims to simplify processes, enhance efficiency, and amplify marketing effectiveness across multiple industries.

Fintel: A Window into Investment Research

Fintel, a comprehensive investing research platform, offers a treasure trove of data, including fundamentals, analyst reports, ownership information, fund sentiment, and insider trading insights. The portal empowers individual investors, traders, and financial advisors with a wealth of resources.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.