Qualcomm and the AI Revolution

As the specter of 2024 looms large, the market abounds with speculations regarding the rise of artificial intelligence (AI). Companies, far and wide, are breathlessly peppering their forecasts with AI jargon as they scramble to reengineer their businesses for the future. One of the towering figures in the ETF realm, Cathie Wood of Ark Invest, has, for years, been a vocal proponent of the AI boom. This week, she has made an intriguing move that could potentially propel her firm into the vanguard of the oncoming technology revolution.

Qualcomm: A Beacon of Technological Innovation

Qualcomm (NASDAQ:QCOM) is a hallowed name in tech lore. Renowned for its smartphone powering chips, the chip giant is undergoing a rapid metamorphosis to expand its dominion into other market domains. Eagerly eyeing the conclusion of this decade, the management is striving to secure a staggering $9 billion in annual revenues within the automotive space. Furthermore, in the recently completed fiscal year of September 2023, its Internet of Things (“IoT”) division reaped a bountiful harvest of nearly $6 billion in revenue.

A Snapshot of Qualcomm’s Financial Landscape

While Qualcomm has recently weathered a tumultuous year, primarily due to macroeconomic headwinds dampening handset sales and manufacturers depleting their heightened inventory reserves, it remains a formidable titan. Despite an almost 20% nosedive in top-line growth, the company has managed to amass over $35 billion in total revenue, with $7.2 billion in GAAP net income, and a staggering near $10 billion in free cash flow. Prognosticators anticipate a robust mid to high single-digit revenue uptick for the current fiscal year and the subsequent two, as the market swells with connected devices and the company ambitiously broadens its product suite.

Qualcomm’s Foray into AI-Powered Chip Architecture

Recently, Qualcomm unveiled a groundbreaking AI-powered chip architecture designed to confer a more immersive quality to both mixed and virtual reality. It is reported that Samsung (OTCPK:SSNLF) and Google (GOOG) (GOOGL) have pledged to utilize the Snapdragon XR2+ Gen 2 in their respective forthcoming mixed reality contraptions. This bold move is a strategic gambit to heighten the competitiveness of these devices in a bid to rival Apple’s Vision Pro headset, which is slated for consumer rollout at the inception of February.

Cathie Wood and Ark Invest’s Qualcomm Acquisitions

Interestingly, with Qualcomm fortifying its AI armaments, Cathie Wood and her team at Ark Invest have plunged into action, adding the company to a couple of their ETF portfolios. Just this week, the ETF powerhouse commenced Qualcomm positions in both the ARK Autonomous Technology & Robotics ETF (ARKQ) and the ARK Next Generation Internet ETF (ARKW). This strategic move is indicative of the ETF firm’s unwavering conviction in Qualcomm’s undoubted potential in the coming AI upheaval.

Qualcomm: A Ship That Glides Against the Tide

Qualcomm, to me, seems like a stalwart value play in this tumultuous space. It may not boast stratospheric revenue or earnings surges within a span of a year, but it doesn’t demand the extravagant premium for such astronomical growth either. The company currently trades at a mere 15 times this year’s anticipated adjusted earnings, a stark contrast to comparable chip denizens like Intel (INTC) and Texas Instruments (TXN), which are commanding valuations upwards of 25 times their forward adjusted earnings estimates. What’s more, Qualcomm offers a palatable dividend yielding around 2.30% annually, and its robust free cash flow has set the stage for a steady buyback that is systematically whittling down the outstanding share count.

Charting Qualcomm’s Trajectory and the Ark Invest Bet

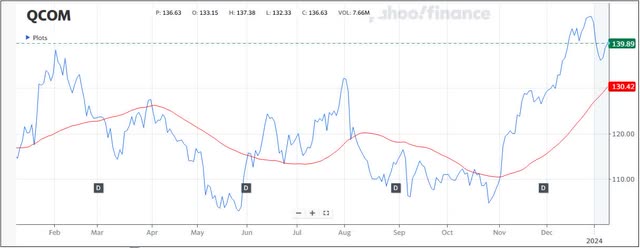

True, the stock has embarked on a meteoric ascent, scaling a towering 35% gain since the latter days of October, ensnared in the sweeping market updraft. However, I’d counsel patience and advocate prudence, urge investors to bide their time, awaiting a potential retreat before making an entry. As the accompanying chart elucidates, the stock boasts a history of dipping below its 50-day moving average, denoted by the scarlet line. In my humble opinion, this dip presents a more opportune threshold for investors, enabling them to snag a higher dividend yield alongside a bargain price. Consequently, I would cautiously recommend a “hold” rating for shares at present.

A Call to Vigilance: An Ark Invest Spotlight on Qualcomm

In summary, Cathie Wood’s decisive move to infuse Qualcomm into two specialized ETFs that predominantly orbit around autonomous technology signifies a seismic shift in focus. Though Qualcomm’s handset business has hogged the limelight, the chip dynamo is primed to gallop ahead in the AI revolution, extending its dominion to power the next wave of reality headsets. This foray might be perceived as more of a value play rather than Ark Invest’s classical high-growth goliaths, particularly given Qualcomm’s quiescent prospects for staggering revenue and earnings expansion — a sharp departure from some of Ark’s riskier holdings. However, with Qualcomm, investors aren’t forking out an exorbitant amount for a slice of the pie, and the company has a robust capital return strategy etched in stone. The road ahead is beset with intrigue — it remains to be seen just how prominent a perch Qualcomm will ascend to in these ETFs in the coming months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.