Qualcomm Launches New Snapdragon X Chip Targeting AI Market

Qualcomm Incorporated QCOM has recently made headlines with the release of its Snapdragon X chip designed for mid-range AI (artificial intelligence) laptops and desktops. This new system-on-chip (SoC) is the fourth entry in the Snapdragon X series, following the successful Snapdragon X Plus 8-core, Snapdragon X Plus, and Snapdragon X Elite models.

Entering the AI Arena with Snapdragon

Manufactured on a cutting-edge 4-nanometer process, the Snapdragon X chip features an 8-core Oryon central processor, a graphics unit, and a neural processing unit (NPU). The NPU significantly boosts AI tasks, delivering 45 TOPS (trillions of operations per second). This positions the chip perfectly for Microsoft Corporation’s MSFT Copilot+PCs, which showcase AI-first flagship Windows hardware. These AI-enabled PCs are expected to launch in the first quarter priced around $600, making them accessible to a broader audience.

Qualcomm’s Shift to AI-Driven Devices

AI PCs include an extra processor dedicated to enhancing AI features. This dedicated hardware improves functionalities like virtual assistants and task automation, with battery life being a notable advantage. Qualcomm’s chips are built on Arm Holdings Plc designs and are known for energy efficiency, providing lasting usage without frequent recharging.

By utilizing advanced multi-core CPUs, impressive graphics capabilities, and global network connectivity, Qualcomm’s Snapdragon mobile platforms create incredibly fast and efficient devices. Smartphones powered by these platforms can enable outstanding augmented and virtual reality experiences, as well as excellent camera functionalities, superior 4G LTE and 5G connectivity, and advanced security features.

Given the slowdown in the smartphone market, Qualcomm is actively pursuing further AI integration within laptop and desktop frameworks. This strategic shift not only diversifies its revenue sources but also strengthens QCOM’s presence in the AI sector. The latest AI chips are posing serious competition to Intel Corporation’s INTC Core 5 120U processor, which is also a player in the mid-range PC market.

Strong Growth in EDGE and Automotive Sectors

Qualcomm is successfully transitioning from being a wireless communications firm to a connected processor leader for intelligent edge technologies. With a solid focus on 5G technology and diversified revenue streams, the company is well-positioned to achieve its long-term financial goals.

The company has also seen notable growth in its EDGE networking capabilities, enhancing connectivity across various sectors including automotive, enterprise, smart homes, and wearables. Qualcomm plans to harness AI to meet the surging demands for products that support digital transformation in our cloud-driven economy.

In the automotive domain, its telematics and connectivity platforms are driving trends like connected vehicles and enhanced in-car experiences. Remarkably, automotive revenues surged 68% to a record $899 million in the fourth quarter of fiscal 2024, fueled by more integrated features in new vehicle launches powered by Qualcomm’s Snapdragon Digital Chassis platform. This marks the 16th consecutive quarter of double-digit growth in automotive revenues for Qualcomm.

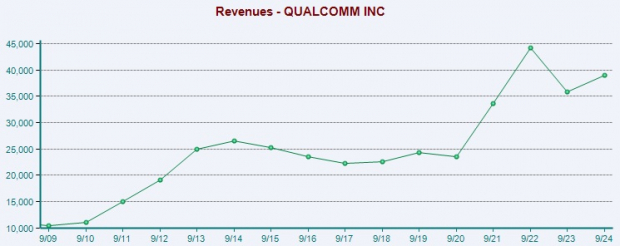

Image Source: Zacks Investment Research

Qualcomm Stock Performance

Qualcomm’s stock has increased by 15% over the past year, although it trails behind the wireless equipment industry’s overall growth of 29.5%. Compared to other industry competitors like Hewlett Packard Enterprise Company HPE and Broadcom Inc. AVGO, QCOM has room for improvement.

One-Year Stock Performance of QCOM

Image Source: Zacks Investment Research

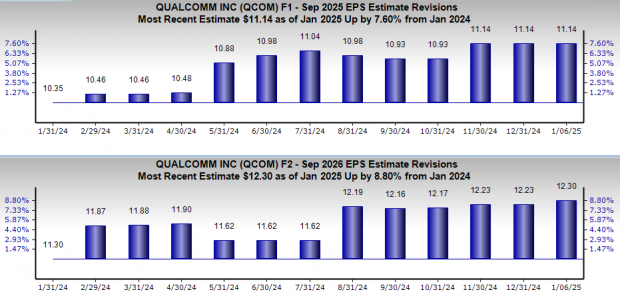

Trends in Earnings Estimates for Qualcomm

Earnings projections for Qualcomm in fiscal 2025 have increased by 7.6% to $11.14, while estimates for fiscal 2026 have risen 8.8% to $12.30. These upward revisions indicate positive sentiments regarding the stock’s future.

Image Source: Zacks Investment Research

Conclusion

Given its robust fundamentals and strong revenue generation driven by increasing demand for AI chips from major clients like Dell and Lenovo, Qualcomm appears to be a promising investment opportunity. A focus on quality, effective execution of operational plans, and ongoing portfolio improvements are enhancing value for stakeholders. With rising earnings estimates, investor confidence in the stock seems to be strengthening.

Over the past four quarters, Qualcomm has achieved a trailing earnings surprise of 7.6%. It currently boasts a VGM Score of B and holds a Zacks Rank #2 (Buy). You can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

An impressive earnings history combined with a favorable Zacks Rank indicates potential for further stock price growth. Consequently, investors might benefit by considering this high-profile stock at present.

5 Stocks Set to Double

These have been carefully chosen by a Zacks expert as top picks expected to gain +100% or more in 2024. While not all selections succeed, past recommendations have seen increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks in this report are currently flying under Wall Street’s radar, presenting a prime opportunity for early investment.

Today, Explore These 5 Potential Home Runs >>

Interested in the most recent recommendations from Zacks Investment Research? Download a free report on the 7 Best Stocks for the Next 30 Days today.

Intel Corporation (INTC): Free Stock Analysis Report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.