Quantum Computing and AI: Comparing D-Wave and NVIDIA’s Market Positions

The intersection of quantum computing, artificial intelligence (AI), and high-performance computing (HPC) is rapidly shaping the future of numerous industries, including healthcare, automotive, and finance. This convergence is attracting the interest of progressive investors. Two companies navigating this technological shift from different perspectives are D-Wave Quantum Inc. (QBTS) and NVIDIA Corporation (NVDA).

As the leader in AI, NVIDIA has become synonymous with GPU technology that accelerates AI processes. In contrast, D-Wave Quantum focuses on quantum computing and is carving a niche in commercial applications with its annealing-based systems, designed to solve optimization problems that conventional computers struggle with.

Recently, QBTS has garnered significant attention, especially following NVIDIA’s change in outlook regarding quantum computing’s potential after initially expressing skepticism. Meanwhile, NVIDIA has faced challenges due to high tariff impacts during the Trump administration.

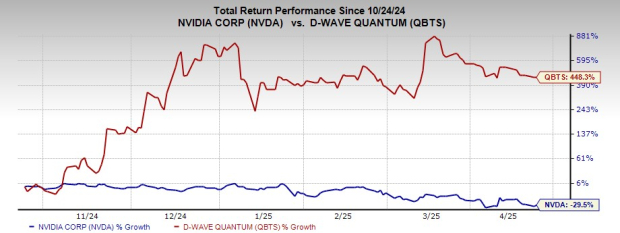

Over the past six months, QBTS shares have skyrocketed by 448.3%, while NVDA shares have decreased by 29.5%.

Image Source: Zacks Investment Research

Does this represent a permanent shift in market dynamics? Can QBTS outperform a tech titan like NVIDIA and emerge as the most strategic investment option? Let’s delve into the details.

NVIDIA’s Long-Term Viability

Data Center Growth: NVIDIA’s Data Center segment has become its primary growth engine, generating $47.5 billion in fiscal 2024 revenues—tripling from the previous fiscal year. In the fourth quarter alone, revenues increased by an impressive 409% year-over-year, totaling $18.4 billion. This growth was driven by high demand for its Hopper GPUs and InfiniBand networking solutions.

Diverse Industry Applications: NVIDIA’s influence crosses various key sectors, including automotive, healthcare, and finance. Over 80 automotive manufacturers utilize its AI platforms like DRIVE and DRIVE Thor, which generated over $1 billion in automotive-related data center revenues in 2024. In the healthcare sector, valued at around $10 trillion globally, platforms such as Clara and BioNeMo foster AI-driven advancements in drug discovery and diagnostics, collaborating with entities like Recursion Pharmaceuticals. Financial institutions, such as American Express, employ NVIDIA’s AI technology to enhance fraud detection and risk management. The significant impact of NVIDIA’s AI technology is evident across different industries.

Strong Financial Performance: NVIDIA reported a solid fourth-quarter non-GAAP gross margin of 76.7%, bolstered by a favorable product mix in the Data Center segment and continual cost efficiencies. The company anticipates normalizing its gross margin to the mid-70s for 2025. Additionally, NVIDIA showcased capital discipline by returning $9.9 billion to shareholders in 2024 through buybacks and dividends, underlining robust free cash flow and a positive long-term growth forecast.

D-Wave Quantum’s Emergence

Pioneering Quantum Technology: D-Wave recently claimed a milestone by becoming the first company to achieve quantum supremacy on a practical problem, simulating a complex material science scenario with its 1,200-qubit Advantage2 system. This notable achievement distinguishes D-Wave from competitors like Google (GOOGL) and IBM (IBM), whose supremacy claims remain more theoretical.

Accelerating Revenue Growth: D-Wave’s commercial traction is increasing rapidly. In the fourth quarter of 2024, bookings escalated by 502%, notably due to the company’s first complete sale of the Advantage system to Germany’s Jülich Supercomputing Centre. Additionally, its Quantum Compute-as-a-Service (QCaaS) model is expanding across industries such as insurance, telecommunications, and public safety.

Healthy Financials and Profitability Prospects: D-Wave Quantum currently holds over $300 million in cash. Although it reported a GAAP net loss attributable to non-operational warrant revaluations, its adjusted net loss has declined year-over-year, and the non-GAAP gross margin increased to 72.8%, showcasing improved operational efficiencies.

Is QBTS Set to Surpass NVDA?

D-Wave’s recent advancements were underscored in a Science paper highlighting its 1,200-qubit Advantage2 prototype solving a material science problem in mere minutes—a feat that would take classical supercomputers millions of years. This significant breakthrough challenges the traditional computing paradigm and raises questions about the future dominance of GPU leaders like NVIDIA.

D-Wave’s business model includes selling systems, as evidenced by the Jülich Supercomputing Centre sale, and offering quantum computing-as-a-service through its Leap platform. This contrasts with NVIDIA’s model, where, despite its leadership in silicon and AI tools, the company still relies on partnerships for quantum technology and lacks a standalone commercial quantum product.

D-Wave’s Valuation vs. NVIDIA

D-Wave Quantum is currently trading at a forward price-to-sales ratio of 67.86X, which exceeds its one-year median of 12.98X. In comparison, NVIDIA is trading at a forward 12-month price-to-sales ratio of 11.79X, below its own one-year median. This indicates that NVIDIA may be more attractively valued relative to D-Wave, as well as in relation to its historical averages.

Image Source: Zacks Investment Research

Price Projections

According to 42 analysts, NVIDIA’s average price target of $177.43 indicates a potential upside of 76.3% from its recent closing price.

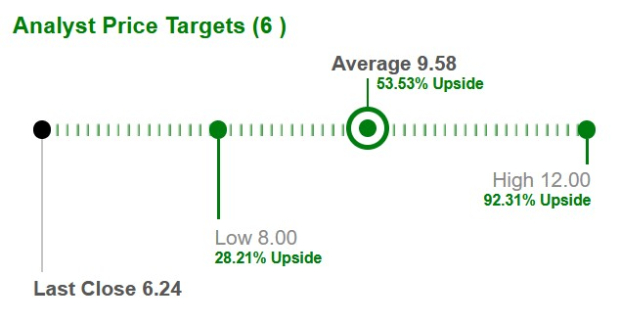

Image Source: Zacks Investment Research

For D-Wave Quantum, the average price target set by seven analysts is $6.71, indicating a modest 0.5% upside from its latest closing price.

Image Source: Zacks Investment Research

D-Wave Quantum: A Promising Investment Opportunity in Quantum Computing

NVIDIA’s Dominance in the Tech Market

NVIDIA’s impressive $2.4 trillion market capitalization highlights its industry dominance. The company’s deep software ecosystem, featuring tools like CUDA and AI stacks, supports its leadership position. It maintains strong liquidity and currently holds a Zacks Rank of #3, indicating a “Hold” recommendation.

D-Wave’s Ascending Position in Quantum Computing

In this landscape, D-Wave is emerging as a significant competitor in the future of computing. If it continues on its current trajectory, D-Wave could become as integral to quantum computing as NVIDIA is to artificial intelligence today. While they may ultimately complement each other rather than compete directly, D-Wave’s strong execution and rapid growth place it at the forefront of the quantum space. For investors seeking early opportunities in quantum commercialization, D-Wave Quantum Inc. (QBTS), presently holding a Zacks Rank of #2 (Buy), presents a compelling option.

Top Stock Picks for the Upcoming Month

Experts have recently identified seven top stocks from the current list of 220 Zacks Rank #1 Strong Buys, suggesting these tickers are “Most Likely for Early Price Pops.” This selection leverages a successful historical track record; since 1988, the complete list has outperformed the market more than twofold, averaging gains of +23.9% annually. Investors should consider these seven stocks for immediate attention.

Further insights are available regarding recent recommendations from Zacks Investment Research, offering a guide to the best investment opportunities.

International Business Machines Corporation (IBM): Free Stock Analysis report available.

NVIDIA Corporation (NVDA): Free Stock Analysis report available.

Alphabet Inc. (GOOGL): Free Stock Analysis report available.

D-Wave Quantum Inc. (QBTS): Free Stock Analysis report available.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.