Investor Michael Burry, famed for his role in the book and movie “The Big Short,” has made significant waves in the financial world once again. Known for his contrarian views, Burry recently revealed that two tech giants, Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG), now account for 10% of his investment firm, Scion Asset Management’s portfolio.

The Amazon Enigma: Unveiling Profit Potentials

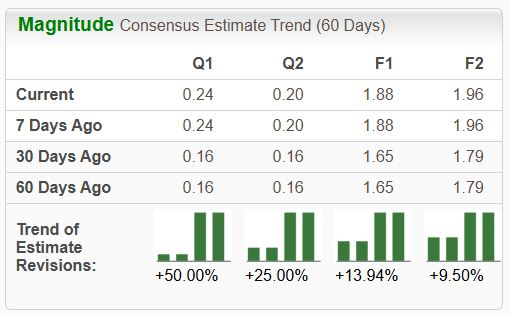

Despite Amazon’s seemingly high P/E ratio of 62, well above the S&P 500 average, signs of profitability have begun to emerge. The e-commerce titan expanded its operating margins significantly in 2023, hitting around 7.5%. Projections indicate a potential rise to 10% margins, driven by the success of its cloud division, Amazon Web Services, and growth in high-margin services like advertising. This strategic shift could position Amazon in a more favorable light, aligning with Burry’s investment thesis.

AMZN PE Ratio data by YCharts.

Alphabet’s Resurgence: Evolution in AI Dominance

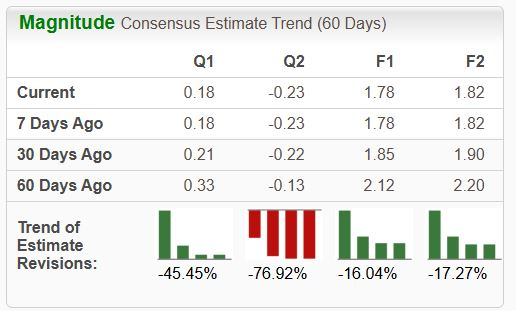

On the other hand, Alphabet faced skepticism in 2023 due to concerns about AI competition. However, recent data shows a strong market position for Alphabet, particularly in Google Search, where it maintains over 90% market share. With promising ventures in YouTube and Google Cloud, Alphabet’s growth trajectory remains compelling. Burry’s bet on Alphabet reflects confidence in its sustained leadership and revenue streams.

Deciphering Investment Insights

While insights from investing legends like Burry can be valuable, blind replication of their strategies may not always yield favorable results. Understanding individual theses and market dynamics is crucial. The delayed disclosure of hedge fund moves adds another layer of complexity, making real-time replication risky.

Guidance on Individual Investing Choices

When contemplating investments such as Amazon, it’s essential to weigh multiple factors. Consider diverse viewpoints, such as those from analysts at Motley Fool Stock Advisor, before making decisions. Construct a portfolio based on personal conviction rather than mirroring others’ actions to navigate the market successfully.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet and Amazon. The Motley Fool has a disclosure policy.