Gold Shines Amid Trade War; Evaluating Investment Opportunities

In the ongoing trade war, gold stands out as the sole “winner.” Amid economic turmoil, gold has been a resilient investment choice.

While many investors are currently flocking to gold, we contrarians believe a better buying opportunity exists on the horizon. In this article, we will analyze four tickers, ranked from least favorable to most favorable. Notably, our top pick offers a dividend that rises alongside gold prices.

Market Overview: Treasury Yields and Economic Concerns

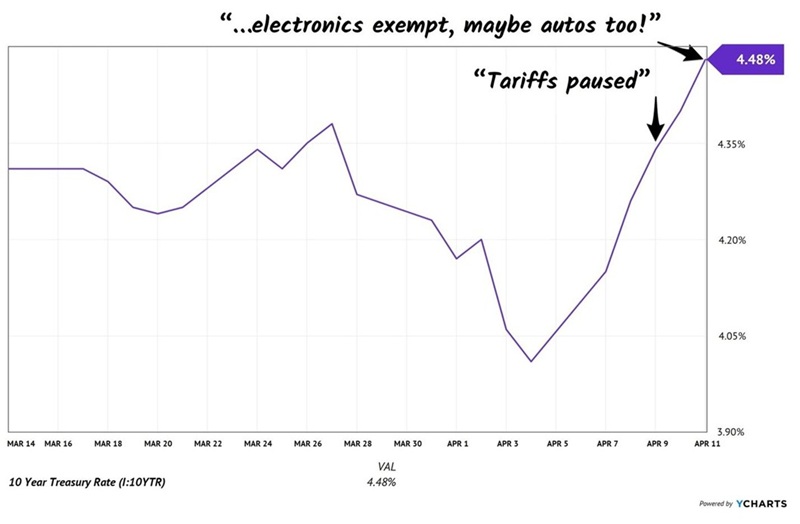

Before diving into those investments, let’s assess the current economic landscape, starting with U.S. Treasury yields. The yield on the 10-year Treasury recently surged from below 4% to 4.5% within days, driven by trade war uncertainties. As of now, yields remain around 4.3%.

This spike is surprising given the growing signs of an economic slowdown, which typically leads to falling yields as investor fears increase.

The reaction from the administration was notable; President Trump eased tariffs whenever yields climbed.

James Carville, famously known as the “Ragin’ Cajun,” aptly remarked on the bond market’s power:

“I would want to come back as the bond market. You can intimidate everybody.”

Interestingly, China has emerged as a major seller of Treasuries, discreetly unloading portions of its $760-billion stockpile.

China’s Role: Boosting Gold Demand

With billions becoming available, what did China decide to invest in? Gold. It’s been reported by The Economic Times that Goldman Sachs (GS) confirmed China purchased 50 metric tons of gold in February, raising its total reserves to 2,292 metric tons, which accounts for 6.5% of its total assets.

As the U.S. implemented tariffs against China, this shift toward gold was strategic. Moreover, China can influence U.S. borrowing costs by reducing its Treasury holdings, further highlighting its pivot towards gold.

It’s no surprise that gold prices have surged, now exceeding $3,300 per ounce. Currently, optimism about gold investments is widespread.

While we share their buying sentiment, the overwhelming bullishness makes us cautious. Heightened popularity in trades often triggers our contrarian instincts, leading us to hold off on immediate gold investments. A decline in gold prices seems almost inevitable.

This potential decline may occur soon, as gold prices dipped slightly after Trump indicated the possibility of reducing tariffs and Treasury Secretary Scott Bessent labeled the trade war “unsustainable.”

Market Movements: Trump’s Shift and Gold’s Adjustments

As we await the next market movements, we should start building our watch list for when gold prices eventually drop. Here’s how various investment options rank from least to most favorable:

Gold ETFs: Decent Choice (No Dividends)

The most recognized gold ETF, SPDR Gold Shares (GLD), mirrors the price of gold bullion minus operational expenses. With a fee around 0.40% of assets, it’s more affordable than personally storing bullion. However, that fee is still considerably higher compared to lower-cost ETFs, like the SPDR S&P 500 ETF Trust (SPY), which charges just 0.09%.

For those seeking a straightforward way to invest in gold, GLD suffices. However, as income-focused investors, we prefer options that deliver dividends, leading us to dismiss this choice.

Gold CEFs: Improved Versus ETFs, Yet Limited Pure Plays

In the closed-end fund (CEF) sector, two options are noteworthy. The first is ASA Gold and Precious Metals Limited (ASA), which focuses on mining firms while also holding physical gold and other precious metals.

While ASA primarily invests in Canadian (82%) and Australian (13.5%) firms, its portfolio includes a significant portion of speculative investments, with 26% in exploratory ventures. Currently, it trades at an 11.8% discount to its net asset value (NAV).

This fund has outperformed GLD over the past decade, but it comes with higher volatility given its speculative nature:

ASA Performance: A Wild Ride

Despite its volatility, the dividend yield is minimal (approximately 0.1%), and although that 11.8% discount seems appealing, it remains stagnant.

Passing on ASA…

If you aim to outperform gold prices in the long term and are open to exposure in other precious metals while accepting greater risk, ASA can be a viable option.

The next noteworthy pick from the CEF universe is the GAMCO Global Gold, Natural Resources & Income Trust (GGN). It addresses our income concern with a solid 8.4% yield.

However, GGN is not exclusively focused on gold; over half its portfolio is made up of mining stocks, including non-gold plays like Rio Tinto (RIO). Additionally, a significant portion is allocated to energy stocks.

Lastly, GGN does not provide substantial discounts either, typically holding around a 1.4% discount:

GGN: Limited Additional Upside

# Gold Stocks: Strategy Amid Price Fluctuations

GGN continues to lag in the gold sector, with a year-to-date increase of about 16%, significantly lower than the 25% rise of gold-tracking ETFs.

Which brings us to …

Focus on Dividend-Paying Gold Stocks

For investors looking to capitalize on potential dips in gold prices, dividend-paying gold miners like Newmont Corp. (NEM) stand out. This strategy is particularly advantageous if energy prices remain low, reducing operational costs for these companies.

This strategy was set in motion when we purchased NEM in my Hidden Yields advisory in June 2023. At that time, gold was trading at approximately $1,960 an ounce with WTI oil priced around $70. We anticipated gold reaching $2,500 as Federal Reserve Chairman Jay Powell took a firm stance on inflation while simultaneously ensuring ample liquidity in financial markets.

Indicators of Powell’s “Quiet QE” were evident in the surge of AI stocks and a rising NASDAQ, neither of which typically happen when the Fed tightens monetary policy.

Our projection for gold unfolded precisely as expected. The Fed’s subtle easing transitioned to a more direct approach, propelling gold prices to $2,650 and benefiting miners like NEM. After a year and a half, we sold the stock, achieving a commendable 29% total return.

Last NEM Holding Delivered 29% Gains

Currently, NEM offers a yield of 1.9% along with a base dividend plus a variable component tied to gold prices. This structure is acceptable, provided the right buying conditions arise.

In anticipation of a future opportunity—specifically, a drop in gold prices combined with ongoing weakness in energy costs—NEM may re-enter our portfolio. I will inform Hidden Yields members whenever this opportunity becomes available.

Preparing for the Next Gold Dip

To position yourself for the next significant increase in our preferred gold stocks, consider starting a risk-free trial of Hidden Yields.

Understanding the underlying dynamics of our Hidden Yields successes hinges on the concept of the Dividend Magnet.

This catalyst tends to drive share prices up as companies increase their dividends. To date, it has led us to total returns exceeding 61%, 112%, and even 148% over various periods.

Currently, it is indicating that 5 elite dividend growers are primed for further gains, and I have compiled this information in an exclusive Special report.

Here’s the plan: I will elucidate how the Dividend Magnet operates and provide you with a free Special report detailing the 5 stocks it is currently highlighting.

You will also receive a VIP invitation for a risk-free 60-day trial of Hidden Yields, granting full access to the service’s portfolio. This is an informed approach to wealth building during uncertain times.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.