“`html

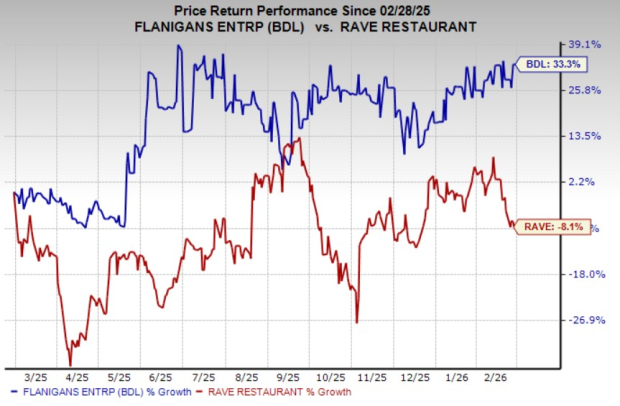

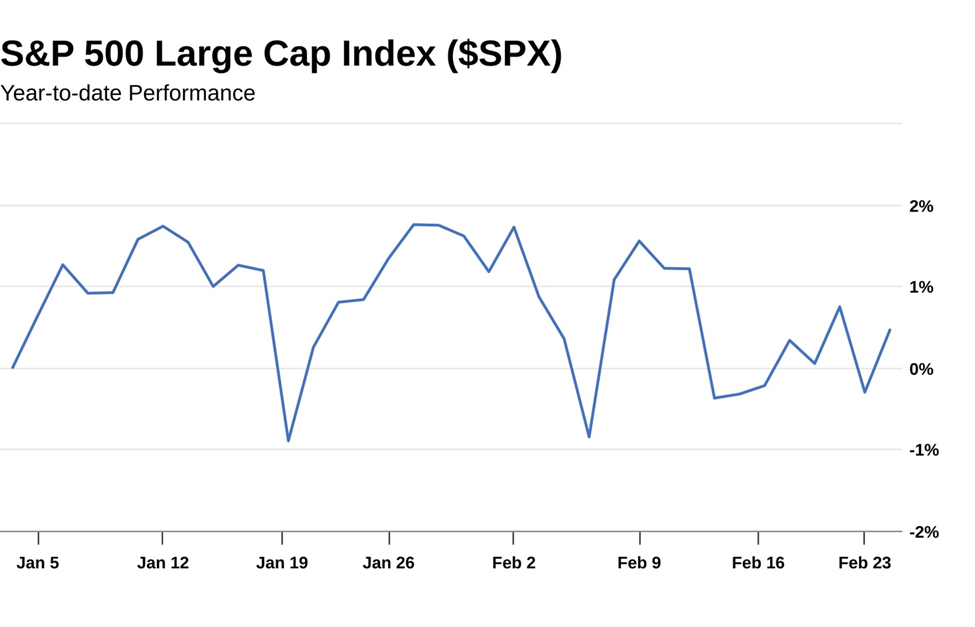

Rave Restaurant Group, Inc. (RAVE) saw shares decline by 9.4% after reporting earnings for the quarter ended June 29, 2025, while the S&P 500 Index increased by 1%. In this fourth-quarter report, RAVE’s net income was $0.8 million (down 3.6% year-over-year) with diluted earnings per share (EPS) remaining flat at $0.06. Total revenues dropped 6% to $3.2 million primarily due to a shorter quarter (13 weeks vs. 14 weeks last year).

Key Financial Data

For the full fiscal year, net income rose 9.3% to $2.7 million, while EPS increased 11.8% to $0.19. Revenues fell to $12 million, a decline of 0.9%. The company reported an annual adjusted EBITDA of $3.6 million, marking a 13.5% increase from the previous year. As of June 2025, RAVE held $2.9 million in cash and $7 million in short-term investments, enhancing its liquidity position.

Operational Highlights

CEO Brandon Solano noted a successful promotional campaign at Pizza Inn, resulting in a 30.6% sales lift. The company is expanding its footprint with 31 new domestic restaurants under contract, while also pursuing international growth in Egypt and Saudi Arabia.

“`