Raymond James Upgrades Nasdaq: Insight into Institutional Sentiment

On October 14, 2024, Fintel reported that Raymond James has upgraded Nasdaq (WBAG:NDAQ) from Market Perform to Outperform.

Understanding Fund Sentiment

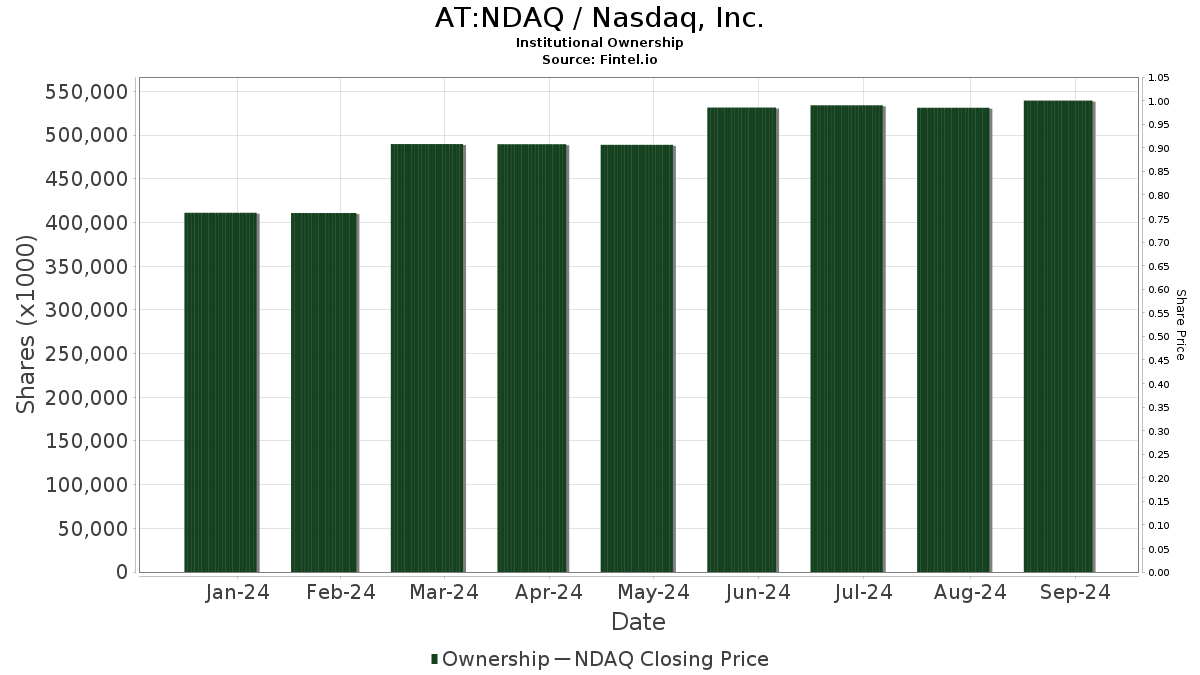

There are currently 1,456 funds or institutions with positions in Nasdaq, marking a decrease of 19 owners or 1.29% over the last quarter. The average portfolio weight for all funds invested in NDAQ is 0.32%, which has grown by 2.13%. Over the past three months, total shares owned by institutions rose 2.17%, reaching 540,890K shares.

Recent Movements Among Other Shareholders

Thoma Bravo maintains a substantial stake, holding 85,608K shares which account for 14.86% ownership. This figure showed no change from the previous quarter.

Investor Ab continues to hold 58,182K shares, representing a 10.10% ownership in Nasdaq, also unchanged from last quarter.

Massachusetts Financial Services now owns 20,884K shares, equating to 3.63% ownership. This represents a decrease from their previous holdings of 21,224K shares, a decline of 1.62%. The firm’s portfolio allocation in NDAQ has decreased sharply by 85.16% over the last quarter.

Wellington Management Group LLP has increased its stake in Nasdaq. They now hold 14,749K shares, representing 2.56% ownership, a notable rise from their earlier holdings of 10,693K shares—a significant increase of 27.50%. Nonetheless, Wellington has also cut down its portfolio allocation in NDAQ by 81.30% during the last quarter.

MEIAX – MFS Value Fund A holds 14,025K shares, corresponding to 2.44% ownership. The firm saw a slight drop from 14,319K shares previously, reflecting a 2.10% decrease. However, their portfolio allocation in NDAQ has risen by 2.45% over the last quarter.

Fintel is recognized as one of the comprehensive investing research platforms catering to individual investors, traders, financial advisors, and small hedge funds.

Our platform provides global coverage and includes data on fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Additionally, our exclusive stock picks leverage advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.