T-Mobile US Faces Downgrade as Analyst Outlook Shifts

Raymond James Adjusts Rating, Suggesting Limited Growth Ahead

Fintel reports that on October 25, 2024, Raymond James downgraded their outlook for T-Mobile US (XTRA:TM5) from Outperform to Market Perform.

Analyst Price Forecast Indicates Potential Drop

As of October 22, 2024, the average one-year price target for T-Mobile US is 205.14 €/share. These forecasts range from a low of 133.39 € to a high of 251.28 €. This average price target reflects a 4.63% decrease from the latest reported closing price of 215.10 € / share.

For more insights, check our list of companies with the most significant price target upsides.

The projected annual revenue for T-Mobile US is 85,315 million euros, marking a 6.64% increase. The expected annual non-GAAP EPS stands at 9.79.

What is the Current Fund Sentiment?

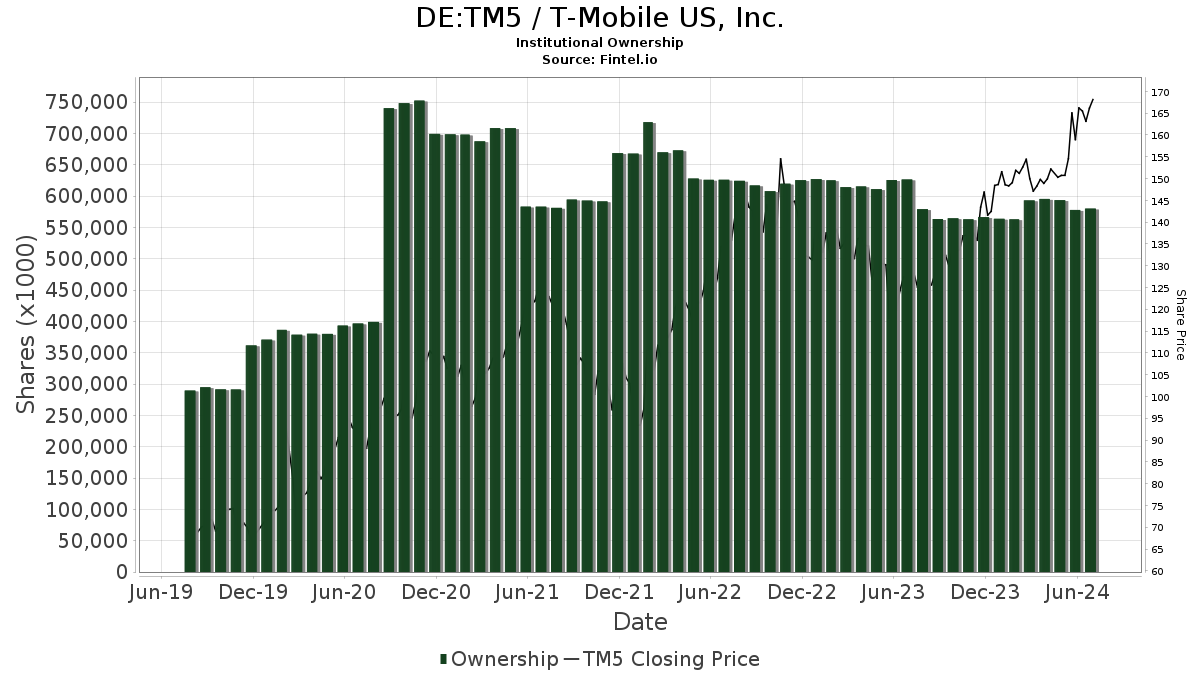

As of now, 2,524 funds or institutions are reporting positions in T-Mobile US. This represents an increase of 91 owners, or 3.74%, within the last quarter. The average portfolio weight of all funds dedicated to TM5 is 0.50%, a rise of 0.69%. Total shares owned by institutions rose by 0.03% over the past three months to 580,351K shares.

What Actions are Other Shareholders Taking?

Softbank Group controls 85,361K shares, which represents 7.32% ownership in T-Mobile. This figure decreased from a previous holding of 92,090K shares, showing a decrease of 7.88%. The firm also reduced its portfolio allocation in TM5 by 0.66% over the last quarter.

Price T Rowe Associates holds 24,311K shares, making up 2.08% ownership. In its last filing, the firm reported 30,441K shares, a decrease of 25.21%. Its allocation in TM5 was cut by 15.84% over the previous quarter.

Invesco QQQ Trust, Series 1, owns 22,570K shares, equivalent to 1.93% ownership. The firm previously reported owning 22,247K shares, indicating a slight increase of 1.43%. However, its portfolio allocation in TM5 decreased by 1.43% in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 16,660K shares, representing 1.43% ownership. This is down from 16,763K shares in the prior filing, reflecting a drop of 0.61%. Nevertheless, its portfolio allocation in TM5 increased by 4.32% last quarter.

Norges Bank has recently acquired 15,146K shares, now holding 1.30% of the company. Previously, it reported no shares, marking a significant increase of 100.00%.

Fintel provides a thorough investment research platform for individual investors, traders, financial advisors, and small hedge funds.

We offer global data, including fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options flow, unusual options trades, and more. Our unique stock picks are supported by advanced, backtested quantitative models aiming to enhance profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.