Raymond James Downgrades Amazon Forecast, Yet Price Target Reflects Growth

Fintel reports that on April 21, 2025, Raymond James revised their outlook for Amazon.com (XTRA:AMZ) from Strong Buy to Outperform.

Analyst Price Forecast Indicates Strong Potential Upside

As of April 3, 2025, the average one-year price target for Amazon.com stands at 246.49 €/share. This forecast spans a range, with a low estimate of 165.92 € and a high estimate of 293.23 €. The consensus average suggests an increase of 62.49% from the most recent closing price of 151.70 € per share.

Explore our leaderboard showcasing companies with the largest price target upsides.

Projected Revenue and EPS Growth

The anticipated annual revenue for Amazon.com is projected at 717,872MM, reflecting an increase of 12.53%. Furthermore, the annual non-GAAP EPS is estimated at 3.73.

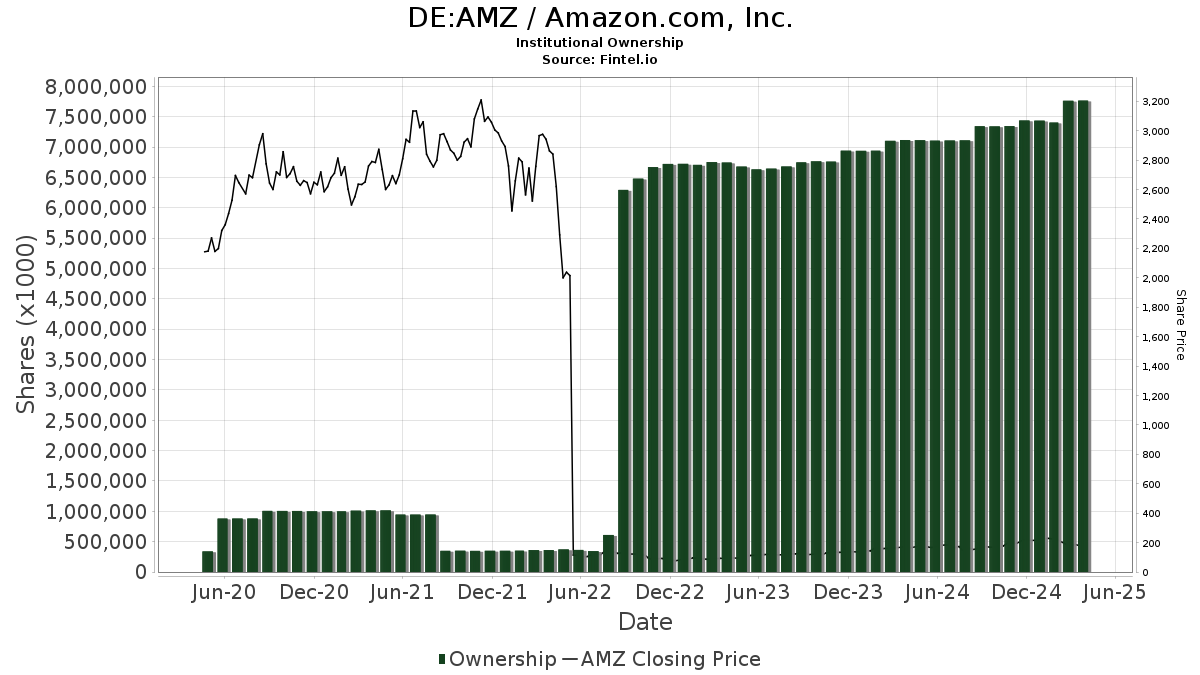

Current Fund Sentiment Towards Amazon.com

A total of 7,518 funds or institutions currently report holdings in Amazon.com, marking an increase of 593 owners, or 8.56%, over the last quarter. The average portfolio weight dedicated to AMZ is 2.60%, showing a substantial increase of 131.54%. Institutional ownership saw a rise of 4.84%, with total shares owned now at 7,772,204K shares.

Shareholder Actions and Changes in Holdings

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 296,490K shares, which represents 2.79% ownership of Amazon. This is a slight decrease from its previous filings, which showed 299,426K shares, a change of -0.99%. However, the firm has increased its portfolio allocation to AMZ by 14.89% over the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) now holds 253,324K shares, equating to 2.39% ownership. This reflects an increase from the prior quarter’s 244,617K shares, marking a 3.44% uptick in holdings, alongside a 15.36% rise in portfolio allocation.

Geode Capital Management has increased its holdings to 204,930K shares, equivalent to 1.93% ownership, up from 199,915K shares previously, representing a 2.45% increase. Similarly, J.P. Morgan Chase owns 182,881K shares, holding 1.72% of the company, which is an increase from their last report of 179,719K shares, reflecting a 1.73% rise.

Price T. Rowe Associates also increased its holdings, currently owning 182,814K shares, maintaining a 1.72% stake. This is up from 178,726K shares previously, marking a 2.24% increase, and a notable 20.59% boost in their overall portfolio allocation in AMZ over the last quarter.

Fintel is a comprehensive investing research platform available to individual investors, traders, financial advisors, and small hedge funds.

Our extensive data includes fundamentals, analyst reports, ownership details, fund sentiments, options, and much more. Additionally, our exclusive Stock picks are powered by advanced quantitative models designed to enhance profitability.

Click here to learn more.

This article was originally published on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.