Raymond James Downgrades Murphy USA Outlook to Market Perform

Fintel reports that on May 9, 2025, Raymond James downgraded their outlook for Murphy USA (BMV:MUSA1) from Outperform to Market Perform.

Current Fund Sentiment Towards Murphy USA

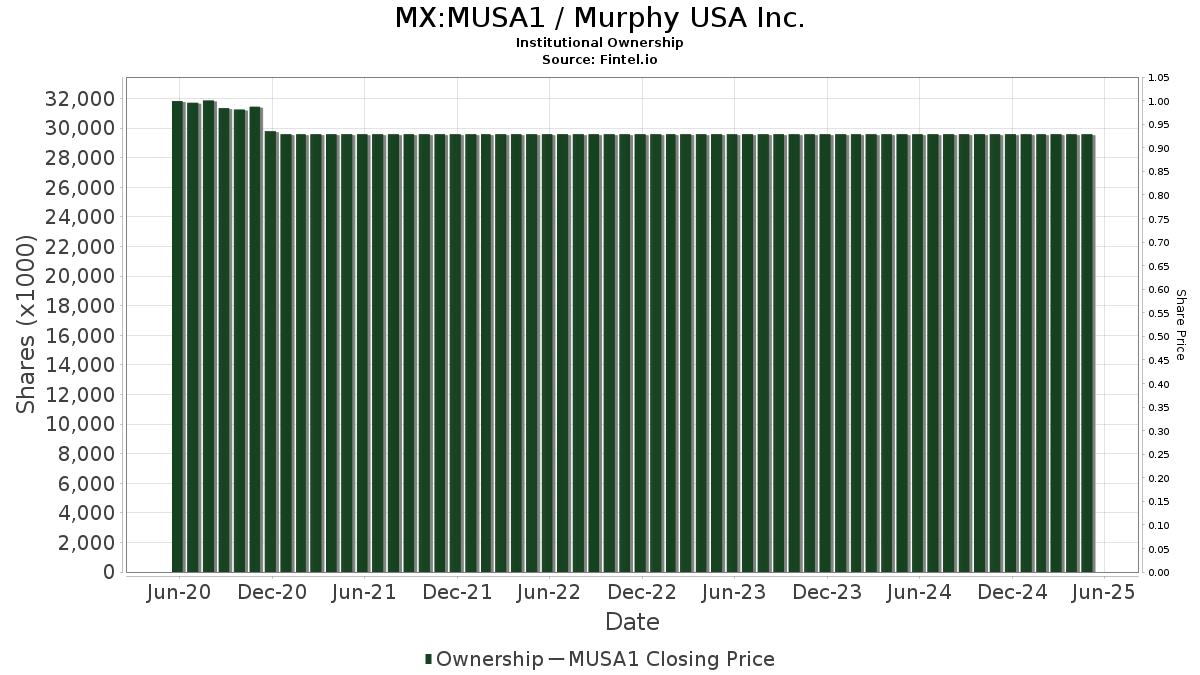

As of now, 752 funds and institutions hold positions in Murphy USA, which reflects a slight increase of 5 owners, or 0.67%, over the last quarter. The average portfolio weight attributed to MUSA1 across all funds is 0.25%, marking an increase of 18.70%. However, total shares owned by institutions decreased by 6.09% in the past three months, now totaling 29,583K shares.

Activity Among Other Shareholders

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 601K shares, representing 2.21% ownership of the company. Previously, the firm reported owning 581K shares, indicating an increase of 3.32%. VTSMX has increased its portfolio allocation in MUSA1 by 3.77% over the last quarter.

iShares Core S&P Mid-Cap ETF (IJH) owns 598K shares, accounting for 2.20% ownership. In its previous filing, it reported 583K shares, showing an increase of 2.54%. IJH has also boosted its portfolio allocation in MUSA1 by 0.32% during the last quarter.

Holocene Advisors holds 529K shares, which represents 1.94% ownership. In the prior quarter, it reported owning 592K shares, a decrease of 11.77%. Holocene Advisors has reduced its MUSA1 portfolio allocation by 27.77% over the past three months.

Vanguard Small-Cap Index Fund Investor Shares (NAESX) possesses 490K shares, equivalent to 1.80% ownership. Previously, it reported owning 462K shares, reflecting an increase of 5.77%. NAESX has increased its allocation in MUSA1 by 5.52% in the last quarter.

Invesco currently holds 471K shares, or 1.73% ownership, having increased from 453K shares in its prior filing, marking a 3.85% uptick. However, its portfolio allocation in MUSA1 has drastically decreased by 90.84% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.