RBC Capital Upgrades Procter & Gamble Outlook to Outperform

Fintel reports that on April 25, 2025, RBC Capital upgraded their outlook for Procter & Gamble (XTRA:PRG) from Sector Perform to Outperform.

Analyst Price Forecast Indicates 12.24% Upside Potential

As of April 23, 2025, the average one-year price target for Procter & Gamble stands at €159.05 per share. Predictions range from a low of €127.02 to a high of €183.13. This average price target signifies a potential increase of 12.24% over its latest closing price of €141.70 per share.

Projected Financial Performance

The anticipated annual revenue for Procter & Gamble is €90.368 billion, reflecting a growth of 7.67%. The projected annual non-GAAP earnings per share (EPS) is estimated at €7.07.

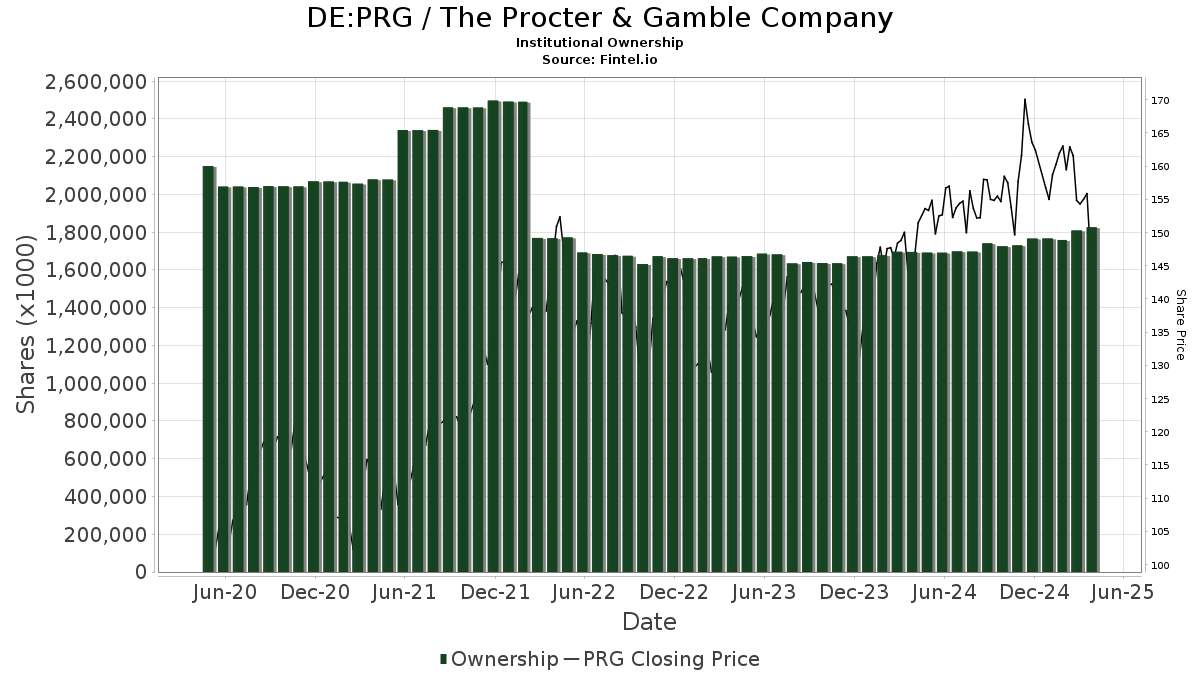

Fund Sentiment Towards Procter & Gamble

Currently, 5,352 funds or institutions are reporting positions in Procter & Gamble, a rise of 229 holders or 4.47% over the last quarter. The average portfolio weight of all funds focused on PRG is 0.70%, which has increased by 0.82%. Total institutional shares owned rose by 3.40% in the past three months, totaling 1,816,568K shares.

Shareholder Activities

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 73,782K shares, representing 3.15% of the company. Previously, the firm reported owning 74,487K shares, indicating a decrease of 0.95%. Its portfolio allocation for PRG saw a decrease of 5.51% in the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 63,749K shares, representing 2.72% of the company. In its last filing, it reported owning 61,654K shares, marking an increase of 3.29%. However, the firm reduced its portfolio allocation in PRG by 5.31% over the last quarter.

Geode Capital Management possesses 56,472K shares, equating to 2.41% ownership. Previously, it reported owning 55,205K shares, showing an increase of 2.24%. Its allocation in PRG fell by 5.12% over the quarter.

Norges Bank now holds 31,282K shares, representing 1.33% ownership, having previously reported no shares, which reflects a 100.00% increase.

Bank of America owns 30,480K shares, representing 1.30% ownership. In its last filing, the firm noted owning 30,986K shares, which shows a decline of 1.66%. It also reduced its portfolio allocation in PRG by 3.78% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.