RBC Capital Downgrades Global Payments Outlook, Predicts Price Decline

Fintel reports that on April 25, 2025, RBC Capital downgraded their outlook for Global Payments (LSE:0IW7) from Outperform to Sector Perform.

Analyst Price Forecast Indicates Potential 20.60% Decline

As of April 24, 2025, the average one-year price target for Global Payments is set at 109.87 GBX per share. The forecasts vary widely; the lowest target is 64.11 GBX, while the highest is at 198.91 GBX. Notably, the average price target suggests a drop of 20.60% from the latest closing price of 138.38 GBX per share.

Projected Revenue and Earnings

The anticipated annual revenue for Global Payments is 9,342 million GBP, reflecting a decrease of 7.56%. Additionally, the projected annual non-GAAP EPS is 11.97.

Fund Sentiment Analysis

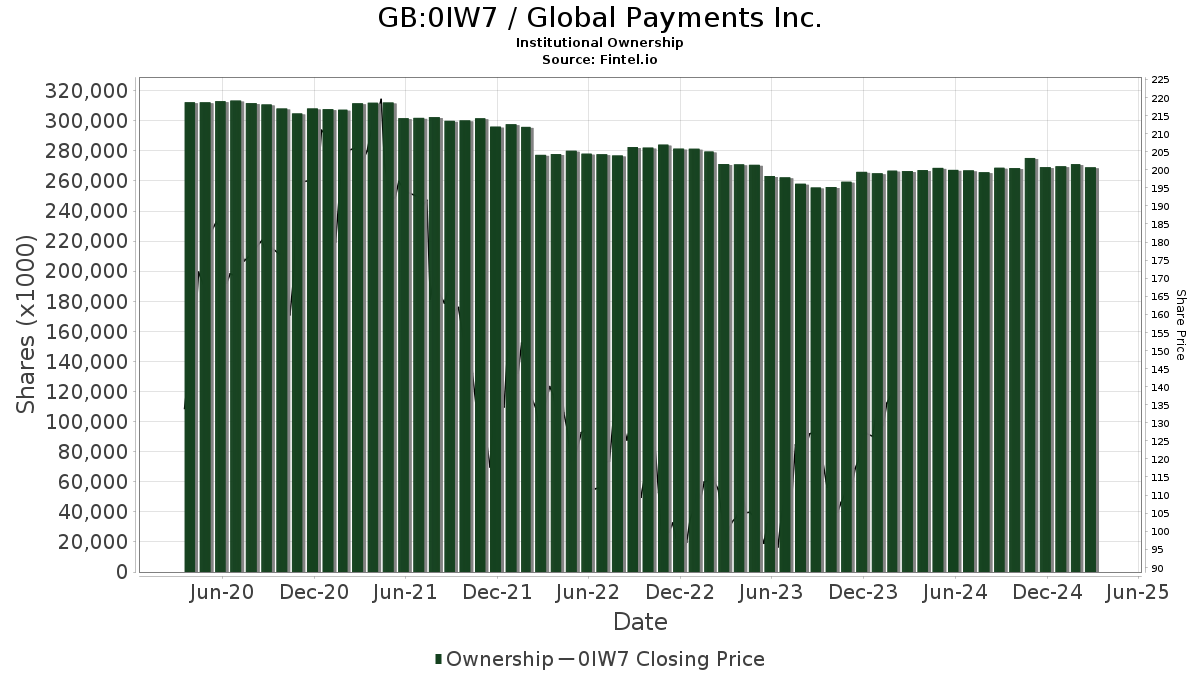

Currently, 1,694 funds or institutions report holdings in Global Payments. This number represents an increase of 13 funds, or 0.77%, compared to the previous quarter. The average portfolio weight dedicated to 0IW7 across all funds stands at 0.34%, showing a rise of 5.71%. However, total institutional shares owned dipped by 0.41% in the last three months to 269,535,000 shares.

Shareholder Activity

Pzena Investment Management holds 8,299,000 shares, accounting for 3.38% ownership in the company. Their previous filing indicated ownership of 6,639,000 shares, marking a 20.00% increase. The firm has raised its portfolio allocation in 0IW7 by 42.41% over the last quarter.

Meanwhile, Synovus Financial has 7,518,000 shares, representing 3.06% ownership. This shows a slight decrease of 0.68% from 7,569,000 shares previously reported. The firm has decreased its portfolio allocation in 0IW7 by 22.34% over the last quarter.

Ameriprise Financial maintains 7,255,000 shares, reflecting a 2.95% ownership stake. Their prior holding was 7,477,000 shares, indicating a 3.06% decrease. However, the firm has increased its portfolio allocation in 0IW7 by 6.03% in the previous quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 6,391,000 shares, corresponding to 2.60% ownership. Previously, they reported 6,509,000 shares, resulting in a 1.85% decrease. Nonetheless, the fund has increased its portfolio allocation in 0IW7 by 5.87% over the last quarter.

Geode Capital Management has reported holding 6,230,000 shares, equating to 2.53% ownership. Their last filing showed ownership of 5,928,000 shares, indicating a 4.85% increase. The firm increased its portfolio allocation in 0IW7 by 10.13% in the last quarter.