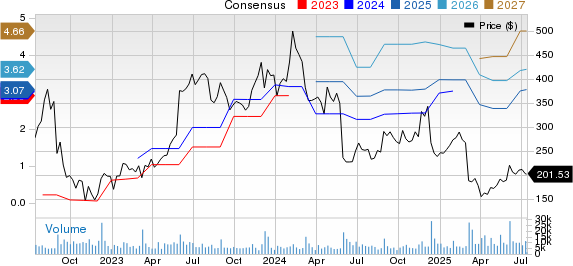

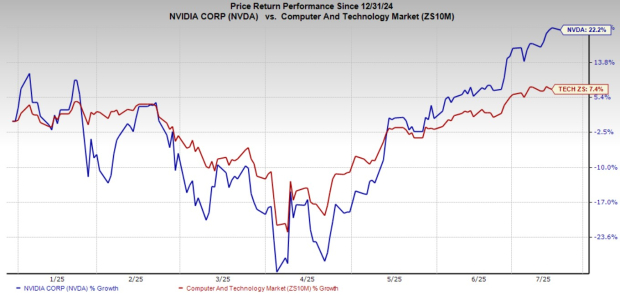

Interactive Brokers (IBKR) is set to report its Q2 results on July 17, with expectations of 8% revenue growth to $1.34 billion and projected EPS of $0.45, a slight increase from $0.44 per share a year prior. The stock has surged nearly 100% over the past year and is currently up 35% year-to-date, reaching a 52-week high of $60 per share.

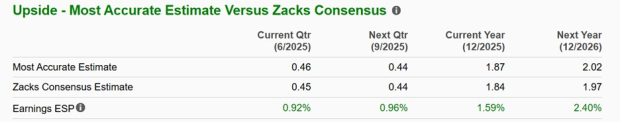

Recent earnings estimate revisions are positive, with FY25 and FY26 EPS forecasts up 4% and 3%, respectively. Annual earnings are projected to grow by 4% this year and an additional 7% next year, while sales are expected to increase by 3% in FY25 and 6% in FY26, reaching $5.73 billion.

Moreover, IBKR trades at a forward earnings multiple of 32.4X, significantly lower than Robinhood’s 79.6X, aligning closer to the industry average of 15.8X. This positions Interactive Brokers as a potentially more affordable growth option in the FinTech sector.