“Tokenization,” especially of “real world assets,” has recently gained significant attention in the crypto world. This trend is essentially a form of security tokens, a term that was popular back in 2018, but for good reason, has since fallen out of favor.

Many of the current promoters of tokenization have found their way from the hype-cycle champion, decentralized finance, otherwise known as DeFi. While influential traditional finance influencers and CEOs view tokenization as a natural evolution in finance, the tokenization of “every financial asset” is much more complex and largely misunderstood by both proponents and detractors.

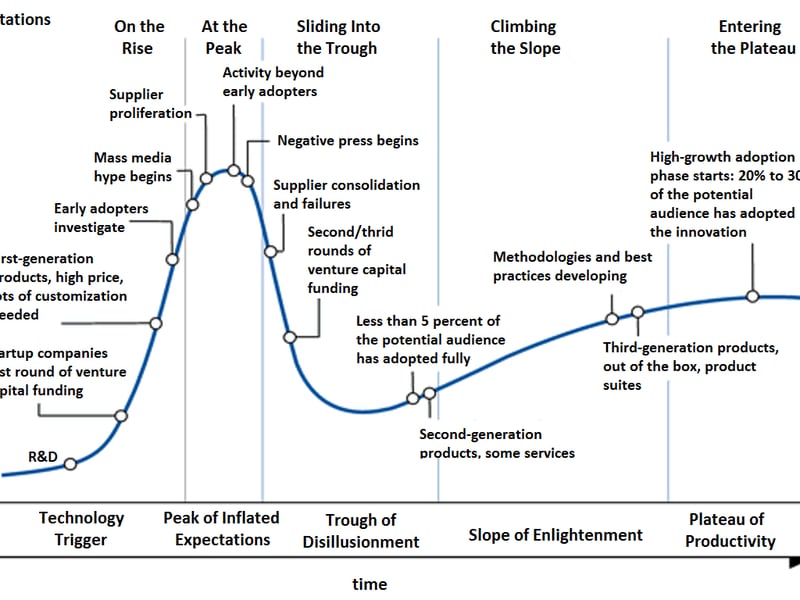

The tokenization of the RWA assets industry has been ongoing for almost eight years, having started in late 2017. Challenges encountered during this journey led some companies to pivot into a “picks and shovels” enterprise software company with an aim to “connect and enable the digital asset ecosystem.” Since then, there has been expansion and subsequent massive contraction of non-fungible tokens (NFT) and DeFi. NFTs and DeFi were easier and more end-user-friendly applications of tokenization technology. However, they have also experienced significant market downturns.

As astute observers of trends, DeFi founders and engineers have migrated towards tokenization due to the changing landscape and challenges associated with previous ventures. However, the claim that the assets and collateral involved in many RWA projects are largely stablecoins, and not actual hard assets, raises concerns about the accuracy of this trend.

Tokenization is not a quiet revolution. In fact, it is currently in the “Supplier Proliferation” phase and expanding rapidly. The ownership of most private assets, the target asset class for RWA, is currently tracked on spreadsheets and centralized databases. Tokenization aims to address these issues by transforming the management of private assets.

The Truth Behind Tokenization

While tokenization, by itself, does not solve liquidity or legality problems when it comes to private assets, it also introduces new challenges. Most RWA projects are engaged in an old process called “rehypothecation,” where the collateral is itself lightly regulated cryptocurrency and the product is a form of a loan.

Firsthand Insights

Building a digital transfer agent and tokenization platform has provided a firsthand perspective on the challenges and complexities of financial asset tokenization. Tokenization is a relatively simple and minor part of the process, and the real complexity lies in the fiduciary responsibilities and the ledger.

Distributed ledgers offer real benefits for tokenizing financial assets by offering immutability, auditability, and trustability. This creates the basis for provable ownership and enables an error-free record of all transactions. The ledger instills the trust necessary for mass adoption of financial asset tokenization.

Before jumping on the hype cycle, it’s essential to understand both the historical context and the future requirements for tokenization. By acknowledging the complexities and potential pitfalls, the financial industry can pave the way for a more sustainable and successful implementation of tokenization.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.