Clean Energy Fuels Corp. Posts Mixed Q3 Results, Investors Remain Cautious

Earlier this month, natural gas supplier Clean Energy Fuels Corp. (CLNE) reported solid third-quarter earnings, showcasing a 9% increase in revenue and a 20% earnings surprise, leading to a 5% rise in its share price. Benefiting from a strong position in renewable natural gas (RNG) and ambitious expansion strategies, CLNE shows promise for the near future. However, potential investors should contemplate valuation concerns and other critical issues before making any decisions.

Understanding Clean Energy’s Business Model

Clean Energy Fuels specializes in RNG as well as traditional natural gas options, including compressed and liquefied natural gas. The company operates over 600 fueling stations across the United States and Canada, focusing on heavy-duty trucks and large vehicles. With a commitment to increasing RNG production, Clean Energy aims to facilitate the transportation industry’s transition to cleaner energy sources.

Image Source: Clean Energy Fuels Corp.

Highlights from Clean Energy’s Q3 Earnings Report

In the third quarter, CLNE sold 59.6 million gallons of RNG, a rise from 56.7 million gallons during the same quarter last year. Although the company reported a net loss, it achieved a positive non-GAAP EPS and an adjusted EBITDA of $21.3 million, improving from $14.2 million in the previous year. Additionally, Clean Energy’s operational and maintenance services made up nearly 14% of revenues during the first nine months of 2024, reflecting a 7.6% increase compared to the same period last year. This recurring revenue, along with an 8% growth in its station construction business, contributes to the company’s financial robustness.

While the figures paint an encouraging picture, several concerns persist that may affect the stock’s performance.

Challenges Facing CLNE Stock

Declining Credit Prices: In the third quarter of 2024, the average Low Carbon Fuel Standard (LCFS) credit price fell to $55.67, down from $74.20 in the same period of 2023. This drop has had a negative effect on Clean Energy’s RNG revenues.

Tax Credit Renewal Uncertainty: Questions surrounding the renewal of the Alternative Fuel Tax Credit (AFTC), which contributed roughly $22 million to Clean Energy Fuels’ revenues in 2024, could create financial strain in 2025. If the AFTC is not prolonged, this revenue source would diminish, impacting profitability.

Delays in RNG Projects: Clean Energy Fuels’ RNG production is still ramping up, with an anticipated output of 4-6 million gallons in 2025. Additionally, the company’s prominent RNG project in Idaho has faced inflated operational costs, which have affected its quarterly performance.

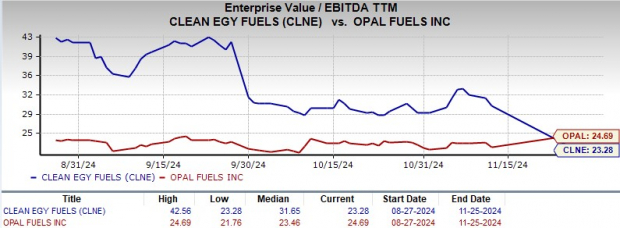

Assessing Clean Energy’s Valuation

From a valuation perspective, CLNE appears less attractive. Its EV/EBITDA (Enterprise Value/Earnings before Interest, Tax, Depreciation, and Amortization) ratio does not compare favorably against other renewable energy companies. The current market capitalization of $621 million marks a significant decline from its peak of $3.5 billion. Furthermore, despite its low stock price, the company has a Value Score of D, which raises additional apprehensions about its financial outlook.

Image Source: Zacks Investment Research

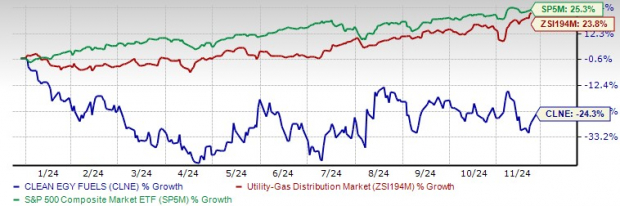

CLNE’s Lagging Stock Performance

To add to its struggles, shares of Clean Energy Fuels have decreased by more than 24% this year, significantly underperforming both the industry and the S&P 500.

Watch CLNE’s Year-to-Date Stock Performance

Image Source: Zacks Investment Research

Despite the downturn in share price, there are several favorable trends for the company.

Positive Aspects Amid Share Price Declines

Expansion through Strategic Partnerships: Clean Energy Fuels is making strides through its collaboration with Amazon (AMZN), a partnership that underscores its capability to secure major allies. The recent opening of a fueling station in Bordentown, NJ—part of this Amazon deal—contributes to a network that has grown nearly 15% in 2024. These strategically located stations cater to Amazon trucks and other heavy-duty fleets, positioning Clean Energy to meet increasing demand.

Growth in RNG Production: The partnership with Maas Energy is facilitating an increase in RNG production. The collaboration currently boasts six operational projects, with two more expected to finalize by late 2025. Utilizing the covered lagoon method, Maas Energy enhances dairy-based RNG production. Clean Energy’s expansion in states like Georgia, Florida, and South Dakota aligns well with the escalating need for renewable energy in transportation.

Shift Toward Production Ownership: Clean Energy Fuels aims to boost its stake in RNG production facilities by collaborating with partners such as BP plc (BP) and TotalEnergies (TTE). This transition from distributor to producer may allow the company to enjoy improved margins and access to additional environmental credits.

Conclusion: CLNE Stock Gets a Hold Rating

While Clean Energy Fuels’ Q3 performance displayed considerable revenue growth and profit improvements, significant challenges remain. Falling credit prices, the impending uncertainty of tax credits, and project delays cast doubts on the company’s near-term outlook. Coupled with lukewarm valuation metrics and a weakening stock price, these issues indicate that the positive earnings report alone might not suffice to endorse a bold investment stance.

Currently, Clean Energy Fuels holds a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks for Potential Doubling

These stocks were handpicked by Zacks experts as top choices for gaining +100% or more in 2024. Though results aren’t guaranteed, past recommendations have seen remarkable gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in this report are currently unnoticed by Wall Street, presenting an opportunity for early investment.

Today, check out these 5 potential home runs >>

Interested in the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

BP p.l.c. (BP): Free Stock Analysis Report

Clean Energy Fuels Corp. (CLNE): Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.