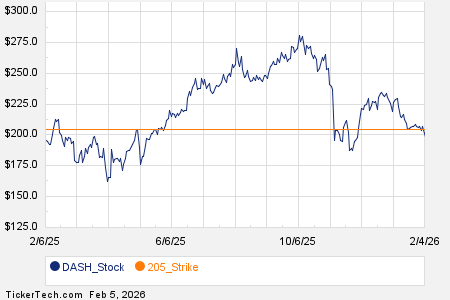

Oracle Struggles Amid Market Concerns

Oracle Corporation (NYSE: ORCL) faced a 15.8% decline in stock value this week, contributing to an overall drop of nearly 29% in 2026, as of Thursday at 2 p.m. The company’s challenges primarily stem from its $300 billion deal with OpenAI, where fears are rising regarding Oracle’s financial exposure and the capital needed for infrastructure, particularly as OpenAI requires over $200 billion for its growth plans. Additionally, Nvidia recently retracted its stated intention to invest $100 billion in OpenAI, heightening investor concerns.

Furthermore, Oracle’s credit default swap pricing has remained elevated since November due to investor anxiety, despite successfully raising $25 billion in bonds as part of a $50 billion funding strategy. Compounding these issues, Oracle is now facing a class action lawsuit from bond investors claiming the company failed to disclose its need for increased debt during the bond issuance.

Overall, Oracle is under pressure as market sentiment wavers over its investments in AI, with analysts suggesting that unless additional funding emerges for OpenAI, Oracle’s stock could continue to struggle.