Market Turmoil: Speculative Tech Stocks Witness Significant Decline

The market experienced a steep sell-off of speculative stocks on Monday as signs pointed to increased turbulence in the U.S. economy driven by escalating tariffs. The U.S. dollar declined, yields rose, and business confidence fell sharply.

Impact on Tech Stocks and Financial Stability

Tech stocks were among the most affected, though not limited to this sector. Firms with solid cash flow and strong balance sheets held their ground better than their speculative counterparts. However, companies with less financial stability faced significant losses. Digital Turbine (NASDAQ: APPS) dropped by as much as 10.9% on Monday, while Quantum Computing (NASDAQ: QUBT) fell 10.1%, and CoreWeave (NASDAQ: CRWV) plunged 14.2% at its lowest point, ending the day down 6.4%, 8.4%, and 9.6% respectively.

Examining the Broader Market Decline

The overall market fell over 3% today, largely due to macroeconomic factors. Tariffs appear to be significantly affecting investor sentiment beyond equities. The dollar index decreased by 1% and has fallen nearly 10% for the year, diminishing U.S. consumers’ purchasing power globally. This decline is compounded by tariffs, which will increase the cost of goods.

Furthermore, yields in the U.S. are on the rise, raising borrowing costs for both companies and government entities. While higher yields pose an economic challenge, they may be necessary to tackle inflation triggered by tariffs. Consequently, investors are increasingly shedding risky assets like equities.

Reasons for the Drop in Speculative Tech Stocks

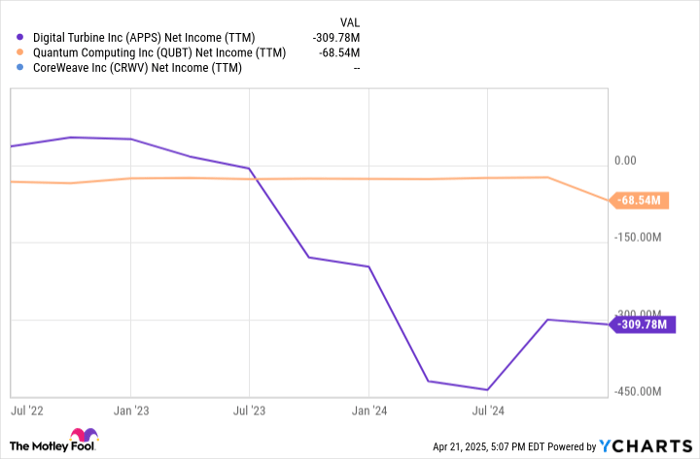

The sharp declines in Digital Turbine, Quantum Computing, and CoreWeave can be attributed to two main factors. These stocks exhibit high volatility, typically amplifying market movements during downturns. Additionally, none of these companies are currently profitable. A downturn in the economy could lead to larger losses and present challenges in raising funds in a tough market.

APPS Net Income (TTM) data by YCharts

Uncertainty remains unwelcome for investors, especially for firms lacking strong financial foundations.

Future Outlook for the Stock Market

The market is currently navigating an uncertain economic landscape, particularly concerning technology companies. The outlook suggests a challenging summer ahead, with tariffs likely stifling consumer spending and rising borrowing costs affecting corporate expansion strategies.

This uncertainty is exacerbated by significant fluctuations in the dollar and yields, which indicate a shift in investors’ perceptions of safety, prompting notable adjustments in the market.

The willingness to invest in unprofitable companies has diminished compared to a few months ago, posing challenges for the future prospects of these stocks. To ensure long-term viability, they will eventually need to increase revenue and achieve profitability.

This period may present an opportunity for investors to focus on high-quality companies potentially positioned for aggressive acquisitions or buybacks during market downturns. Such strategies could lead to favorable outcomes in the current environment.

Should You Consider Investing in CoreWeave?

Before investing in CoreWeave, it is essential to consider the views of our analysts:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for current investment opportunities… and CoreWeave is not among them. The selected stocks are anticipated to deliver substantial returns in the future.

Reflect on past recommendations: Netflix was highlighted on December 17, 2004. An initial $1,000 investment would have grown to $524,747!* Similarly, when Nvidia was listed on April 15, 2005, $1,000 would now equate to $622,041!*

For context, Stock Advisor‘s overall average return is 792%, significantly outperforming the S&P 500’s 153%.

Explore the current top 10 stocks »

*Stock Advisor returns as of April 21, 2025

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.