Marvell Technology’s Stock Surge

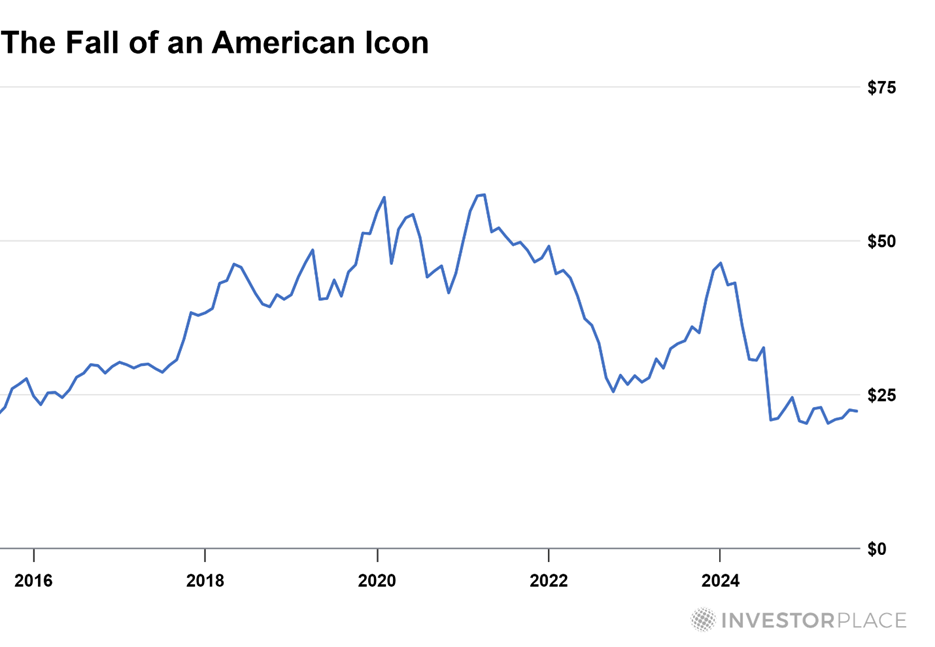

Marvell Technology (NASDAQ: MRVL) saw its shares rise by 7.6% by 12:05 p.m. ET on Wednesday after Morgan Stanley analyst Joseph Moore raised the price target to $80 a share. The stock is currently down about 33% from its peak in late January, despite forecasts of $2.28 earnings per share in 2026.

Key Developments in AI Chip Production

Fubon Research reported that Microsoft (NASDAQ: MSFT) is considering moving from a 3nm to a more advanced 2nm chip for its Maia300 AI project, which Marvell will produce. While this change delays production and revenue from Q1 2026 to Q4 2026, it could present a substantial opportunity, with potential revenue increases of $2.4 billion in 2026 and up to $12 billion in 2027.

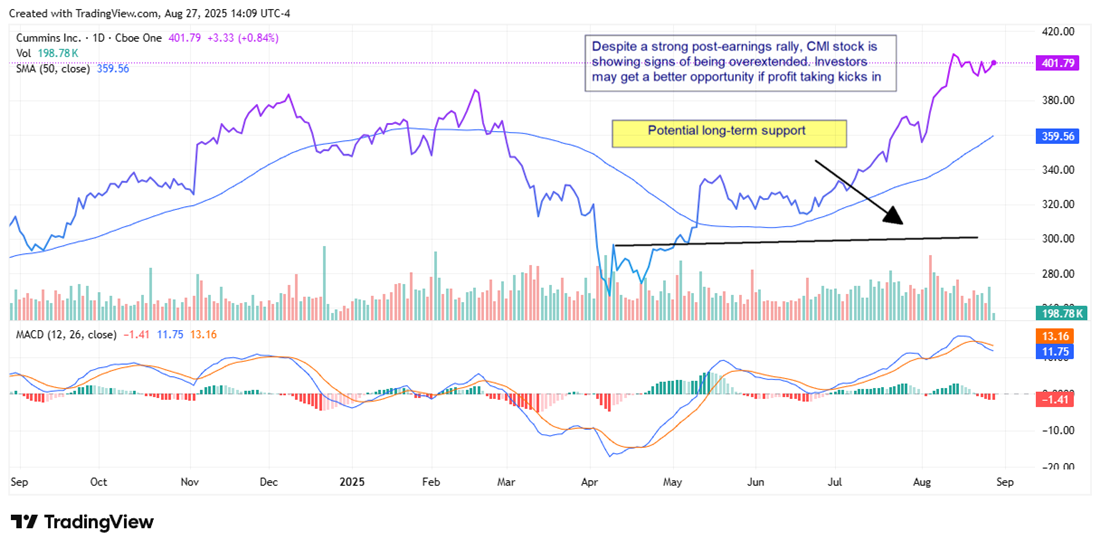

Valuation Considerations

Marvell’s stock currently trades at 47 times this year’s estimated free cash flow; however, analysts project that its free cash flow could double in the next two years, aligning with expected revenue growth.