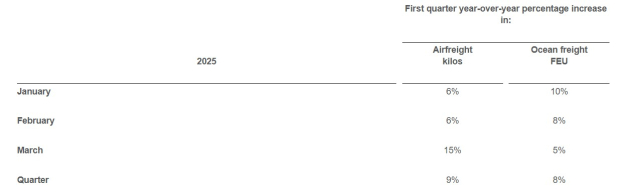

Expeditors International of Washington (EXPD) reported a strong first quarter for 2025, with a 9% increase in airfreight tonnage and an 8% rise in ocean container volumes year-over-year. The company’s current ratio stood at 1.83, indicating robust liquidity, while it announced a dividend increase of 5.5%, raising payouts from $0.73 to $0.77 per share, effective June 16, 2025. Year-to-date, EXPD shares have risen 3.3%.

Despite these positives, EXPD faces challenges, with total operating expenses increasing by 20.5% compared to the previous year, largely due to a 38.6% rise in ocean freight costs. The company anticipates continued global market volatility and potential impacts from geopolitical uncertainties on the logistics industry.

Currently, EXPD holds a Zacks Rank of #3 (Hold). Investors are advised to consider stocks like Copa Holdings (CPA) and Ryanair (RYAAY) as potential alternatives, with respective growth rates of 14.3% and 30.5% anticipated for the current year.