“`html

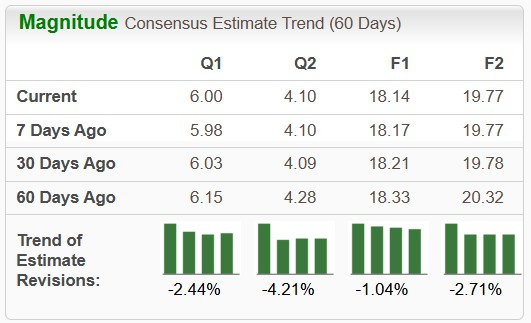

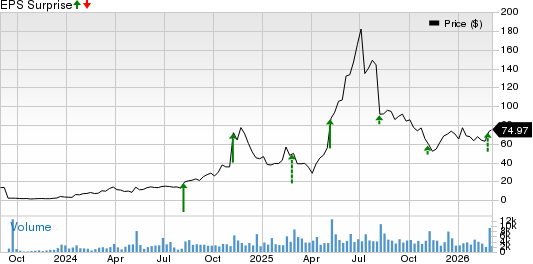

FedEx Corporation (FDX) is facing increased operating expenses that are negatively impacting its performance, prompting concerns among investors. The Zacks Consensus Estimate for current-year earnings has decreased by 2.4% in the last 60 days, and the next year’s consensus earnings estimate has also been revised downward by 1.04%.

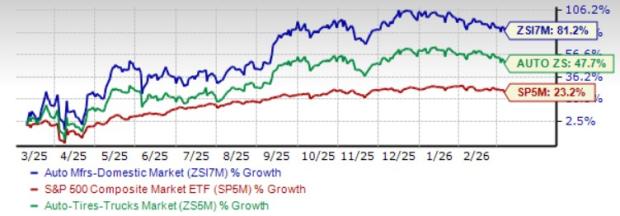

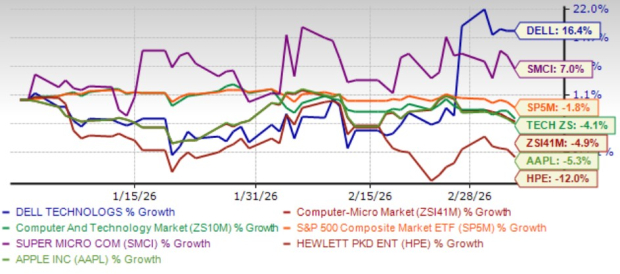

Year-to-date, FedEx shares have dropped 21%, contrasting with a 20.5% rise in the Transportation – Air Freight and Cargo industry. The company’s Zacks Rank is currently #4 (Sell). In Q3 2025, operating expenses rose 2% year-over-year, primarily due to a 57% spike in business optimization costs and a 2% increase in labor expenses, reflecting a lack of immediate efficiency gains.

FedEx continues to contend with challenges such as geopolitical uncertainty and higher inflation, while its Freight segment saw lower operating results due to decreased fuel surcharges and fewer shipments.

“`