Astronics Corp. ATRO is flying high with a sturdy backlog and consistent capital expenditure strategy, underpinned by a robust financial position.

Delve into the underlying aspects that position this Zacks Rank #2 (Buy) company as a prime investment opportunity at this juncture.

Projections Point to Growth

Estimations suggest that Astronics is set to bounce back, with a Zacks Consensus Estimate for earnings per share in 2024 hovering at a promising 71 cents, a notable improvement from a reported loss of 80 cents in 2023.

Furthermore, the Zacks Consensus Estimate for ATRO’s 2024 sales stands at a solid $769 million, showcasing an 11.6% enhancement from the previous year.

Debt Dynamo

With a current ratio of 2.72, Astronics outpaces the industry average of 1.55, signaling its prowess in meeting short-term financial obligations.

Moreover, ATRO’s total debt-to-capital ratio rests at a favorable 40.27%, outperforming the industry benchmark of 54.47%, which speaks volumes about the company’s prudent debt management.

Domination in Order

With a backlog of $592.3 million at the close of 2023’s fourth quarter, Astronics forecasts shipments amounting to $526.5 million for the year 2024.

The Aerospace wing recently achieved an all-time high backlog of $517.2 million, propelled by a 31% spike in sales owing to escalated airline spending and OEM build rates. These figures underscore the robust demand for Astronics’ offerings.

Elevated Expenditure

Astronics maintained capital expenditure at $7.6 million in 2023, equivalent to the previous year, with $5 million funneled into the Aerospace domain.

For 2024, the company anticipates capital expenditure in the range of $17-$22 million, reflecting a commitment to continued growth and innovation.

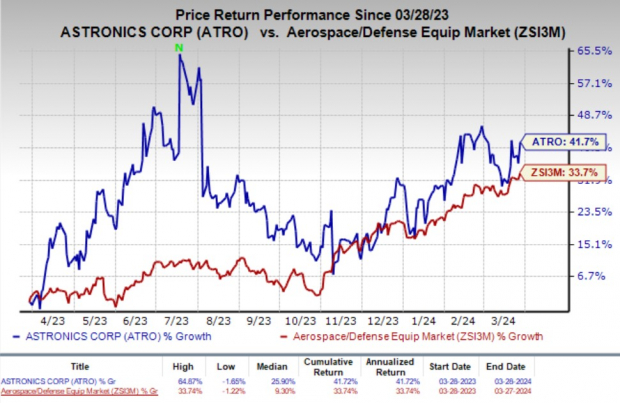

Price Propulsion

In the last year, ATRO shares ascended 41.7%, outperforming the industry’s 33.7% rise, a testament to Astronics’ resilience and investor appeal.

Image Source: Zacks Investment Research

Exploring Alternatives

Among other top-rated players in the sector are Textron Inc. TXT, Leidos Holdings Inc. LDOS, and Safran SA SAFRY, all currently holding a Zacks Rank of 2.

Textron boasts a resilient long-term earnings growth rate of 10.1%, with a Zacks Consensus Estimate for 2024 sales standing at $14.64 billion, showcasing a 7% year-over-year climb.

Leidos flaunts an impressive long-term earnings growth rate of 8.1% and a projected 2024 sales figure of $15.97 billion, indicating a 3.5% annual increase.

Safran shines with a remarkable long-term earnings growth rate of 30.2%. 2024 sales are anticipated to hit $29.40 billion, marking a substantial annual growth of 42.9%.

Zacks Reveals ChatGPT “Sleeper” Stock

Unveil an under-the-radar company at the heart of the burgeoning Artificial Intelligence sector, poised to drive a massive $15.7 Trillion economic impact by 2030.

To equip readers with valuable insights, Zacks offers an exclusive report spotlighting this explosive growth stock along with additional “must-buy” recommendations and more.

Acquire the ChatGPT Stock Report Right Away >>

The perspectives and viewpoints presented herein reflect those of the author and may not align with those of Nasdaq, Inc.