Reasons to Consider the Surge in Cencora (COR) Stock

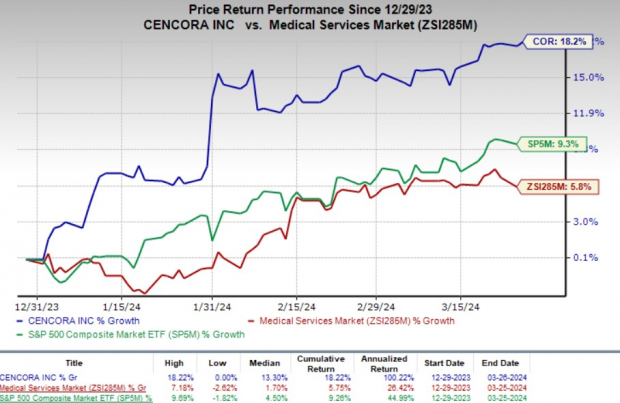

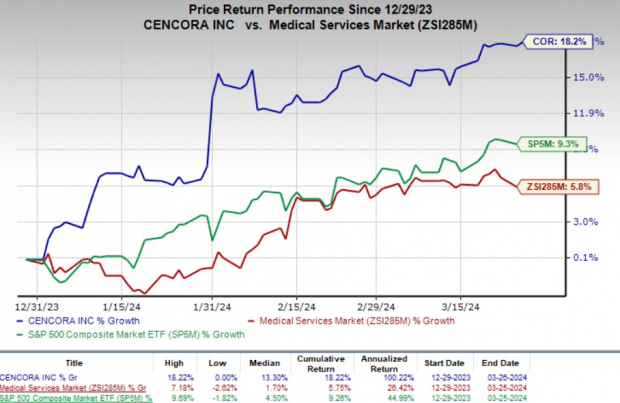

Cencora, Inc. COR stands at the threshold of a lucrative growth phase, propelled by its robust U.S. Healthcare Solutions division and a flurry of new product unveilings. Despite the looming shadow of fierce competition, the stock has soared by 18.2% year-to-date, eclipsing the industry’s 5.8% ascend. In comparison, the S&P 500 Index has inched up by 9.3% over the same time period.

A Gargantuan in the Pharmaceutical Realm

Cencora proudly stands as one of the globe’s largest pharmaceutical service behemoths, specializing in drug distribution and ancillary services aimed at curbing healthcare expenses and enhancing patient outcomes. With a market capitalization of a staggering $48.29 billion, the company is a formidable force to reckon with in the industry.

Image Source: Zacks Investment Research

The trajectory of COR’s bottom line portends a 9.8% upsurge over the next half-decade. Impressively, the company has outshined earnings estimates in all of the past four consecutive quarters, clocking in an average surprise of 6.69%.

Driving Forces Behind the Phenomenal Growth

COR currently operates under the tutelage of two segments — U.S. Healthcare Solutions and International Healthcare Solutions.

The former constitutes the legacy Pharmaceutical Distribution Services (excluding Proforma), MWI Animal Health, Xcenda, Lash Group, and ICS 3PL. It enjoys a surge in volume and an expanding clientele base. The segment is poised to reap the benefits of escalating organic growth rates in the U.S. pharmaceutical domain, enhanced patient access to medical services, improved economic conditions, and favorable population demographics.

Revenues in the first quarter of fiscal 2024 for U.S. Healthcare Solutions amounted to a commendable $65.2 billion, marking a 15.9% uptick from the previous year. This remarkable growth can be attributed to overall market expansion and amplified sales of specialty products. The heightened demand for recently-approved GLP-1 drugs to combat diabetes and facilitate weight loss has significantly fuelled growth during the quarter, culminating in a $698.1 million rise in segmental operating income, a substantial 22% increase from the previous fiscal year.

Relentless innovation and a strategic focus on specialty drugs have positioned Cencora optimally to expedite the product-to-market journey, ensuring efficiency in the process. Imbued with the vision to capitalize on the growth of generics in the long run, investor sentiment towards COR remains buoyant.

The adjusted EPS for fiscal 2024 is anticipated to hover between $13.25 and $13.50, denoting a 6-8.4% elevation from the previous year’s figures. COR estimates a robust revenue growth of 10-12% year over year, underpinning its promising trajectory.

Navigating the Choppy Waters of Competition

While Cencora basks in the glory of its accomplishments, navigating the fiercely competitive pharmaceutical distribution and healthcare services terrain poses a formidable challenge. The sector grapples with a consolidation of customers and manufacturers, global rivals, and stringent regulatory hurdles.

Moreover, the company squares off against manufacturers, chain pharmacies, specialty distributors, and firms specializing in packaging and healthcare technology, heightening the competitive landscape and threatening to cast a shadow over its operations.

Estimate Trajectory: A Promising Outlook

The estimate trend for fiscal 2024 reflects an optimistic trajectory for COR. Over the past 60 days, the Zacks Consensus Estimate for earnings has surged from $12.88 per share to $13.43, underscoring a positive sentiment towards the company.

Predictions for the second quarter of fiscal 2024 revenues peg the figure at $70.35 billion, highlighting a notable 10.9% surge from the corresponding period in the prior year. Meanwhile, the bottom-line estimate is poised at $3.65, signifying a year-over-year uptick of 4.3%.

Considering the Alternatives

Amidst the vibrant medical landscape, other notable stocks worth exploring include DaVita Inc. (DVA), Medpace (MEDP), and Biodesix (BDSX), each boasting an illustrious legacy and promising growth prospects.

DaVita, accorded with a Zacks Rank #1 (Strong Buy), touts an estimated long-term growth rate of 12.1%. DaVita has outperformed earnings estimates in the previous four quarters, amassing an average surprise of 35.57%. The stock has surged by 29.1% since the beginning of the year, eclipsing the industry’s growth rate of 6.7%.

Medpace, fortified with a current Zacks Rank of 1, anticipates a robust estimated long-term growth rate of 18%. MEDP has outshone earnings expectations in all of the trailing four quarters, notching an average surprise of 12.42%. The stock has soared by 31.4% year-to-date, surpassing the industry’s 5.7% growth rate.

Biodesix, boasting a Zacks Rank #2, anticipates a stellar growth rate of 29% for 2024. The firm has outperformed earnings estimates in each of the trailing four quarters, securing an average surprise of 13.96%. Despite Biodesix’s shares plummeting by 21.2% since the beginning of the year, against the industry’s 5.7% growth, investors remain cautiously optimistic about its future trajectory.

Strike While the Iron is Hot: The elixir of the investment world lies in the prudent selection of winning stocks. With prudent analysis and a shrewd eye on market movements, the path to economic prosperity is illuminated. The era of quantum leaps and soaring horizons beckons – investors, harness the winds of change and capitalize on the rise of giants.