“`html

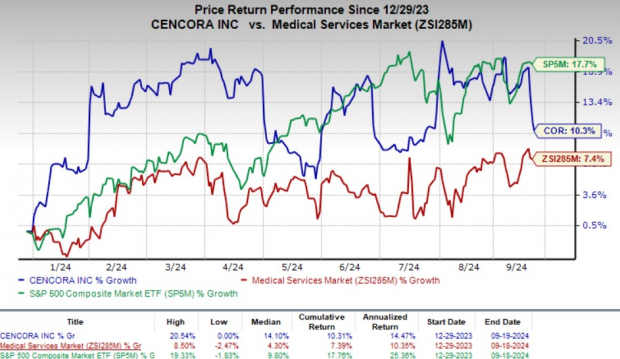

Cencora, Inc. (COR), a major pharmaceutical service provider, has experienced a 10.3% increase in shares year-to-date, outperforming the industry growth of 7.4%. The company, with a market capitalization of $45.02 billion, reported third-quarter revenues of $67.2 billion from its U.S. Healthcare Solutions segment, reflecting a 12.2% year-over-year increase.

In fiscal 2024, Cencora anticipates revenue growth of 12-13% and operating income improvements of 10-12%. Recently, the company raised its adjusted earnings per share guidance to $13.55-$13.65, compared to a previous estimate of $13.35-$13.55, largely due to a reduced share count from a $400 million share repurchase deal with Walgreens Boots Alliance Holdings LLC.

Despite strong growth prospects driven by demand for specialty drugs, particularly GLP-1 products, Cencora faces significant competition in the pharmaceutical distribution market. The consensus estimate for fourth-quarter fiscal 2024 revenues is $77.68 billion, marking a 12.7% increase from the prior year.

“`