Duke Energy’s solid investment plan over the next five years to maintain and upgrade its infrastructure should boost the company’s performance. It will further benefit from a strong solvency position.

Let’s delve into the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

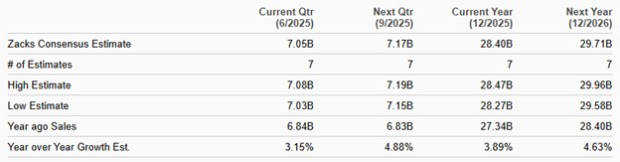

Growth Projections

Duke Energy’s long-term (three to five-year) earnings growth rate is pegged at 5.3%.

The Zacks Consensus Estimate for DUK’s 2024 earnings per share (EPS) stands at $5.97, indicating an improvement of 7.4% from the prior-year reported figure.

The Zacks Consensus Estimate for 2024 sales is pinned at $30.51 billion, suggesting an improvement of 5% from the year-ago reported number.

Return on Equity

Return on Equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, Duke Energy’s ROE is 8.93%, which is higher than the industry’s average of 7.01%. This indicates that the company has been utilizing its funds more effectively than its peers in the electric power utility industry.

Solvency

Times interest earned (TIE) is a solvency ratio. It is used to measure how well the company can cover its interest obligations. The TIE ratio at the end of the fourth quarter of 2023 was 2.58, which, being greater than 1, indicates that Duke Energy is in a good position to meet its interest obligations.

Dividend History

Duke Energy has a history of issuing dividends on its common stock for 98 consecutive years. In January 2024, DUK announced a quarterly dividend of $1.025 per share, resulting in an annual dividend of $4.10. The company’s payout ratio currently is 74% of earnings.

DUK’s current dividend yield is 4.44%, better than the Zacks S&P 500 composite’s 1.32% and its industry’s 3.71%.

Systematic Investments & Clean Energy Transition

Duke Energy continues with systematic investments in its infrastructure development and expansion projects. In 2023, Duke Energy made capital expenditures totaling $12.57 billion. For the 2024-2028 period, the company expects to invest $73 billion, with 50% of the capital plan focused on grid investment. Such investments should enable the company to duly achieve its long-term operating earnings growth in the range of 5-7% through 2028.

Of the 2024-2028 capital plan, approximately $19 billion is allocated for zero-carbon generation, such as solar, wind, and battery storage resources, and extending the life of its nuclear fleet, and approximately $5 billion in hydrogen-enabled natural gas technologies.

For clean energy, Duke Energy aims to install 6,500 megawatts (MW) of solar and 2,700 MW of battery storage by 2031. By 2033, 1,200 MW of onshore wind is expected to be in service. These initiatives will further strengthen DUK’s position in the clean energy transition that the entire utility sector is currently undergoing.

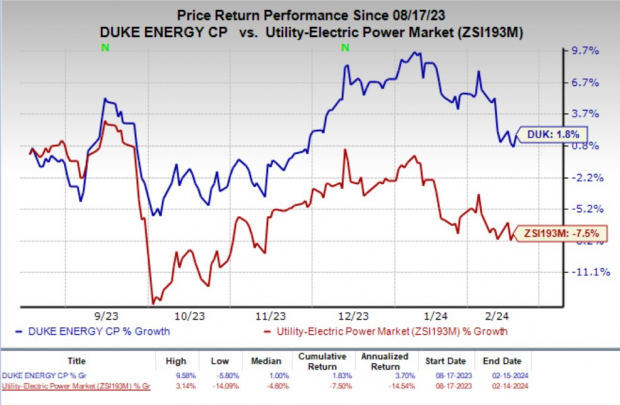

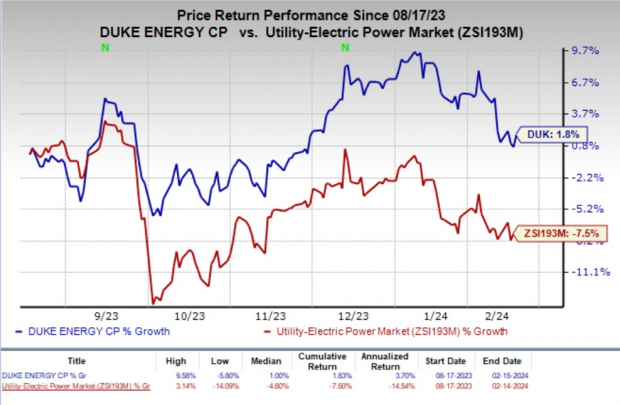

Price Performance

In the past six months, shares of DUK have gained 1.8% against the industry’s 7.5% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are NiSoruce NI, Xcel Energy XEL and DTE Energy DTE. Each stock presently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

NiSource’s long-term earnings growth rate is 7.2%. The Zacks Consensus Estimate for NI’s 2024 earnings indicates an increase of 7.2% from that estimated in 2023.

Xcel Energy’s long-term earnings growth rate is 6%. The Zacks Consensus Estimate for XEL’s 2024 sales implies an improvement of 7.6% from that reported in 2023.

DTE Energy’s long-term earnings growth rate is 6%. The Zacks Consensus Estimate for DTE’s 2024 sales implies an improvement of 13.1% from that reported in 2023.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.