Sempra Energy SRE, with rising earnings estimates and strategic investments, offers a great investment opportunity in the utility sector.

Let’s dive deep into the reasons that make this Zacks Rank #2 (Buy) stock a compelling addition to your investment portfolio.

Growth Projections and Historical Performance

In the past 60 days, the Zacks Consensus Estimate for SRE’s 2024 earnings per share (EPS) has seen a solid 0.83% increase to $4.83. The company also anticipates a 1.84% year-over-year growth in total revenues for 2024, standing at $17.08 billion.

Over the next three to five years, SRE’s earnings growth is forecasted at 4.95%. Notably, the company has surpassed earnings expectations by an average of 9.03% over the past four quarters, signaling a robust performance trend.

Exceptional Return on Equity

Sempra Energy boasts a commendable Return on Equity (ROE) of 9.88%, outperforming the sector’s average of 7.39%. This indicates the efficient utilization of funds by the company to generate higher returns compared to its peers in the industry.

Stellar Dividend History

Highlighting its commitment to shareholders, SRE has consistently increased dividend payments. With a current dividend yield of 3.12%, surpassing the Zacks S&P 500 composite’s yield of 1.6%, SRE’s November 2023 announcement of a quarterly dividend of 59 cents per share and an annual dividend of $2.38 per share underscores its strong dividend track record.

Strategic Systematic Investment

Sempra Energy continues to make substantial investments in infrastructure development projects. Over the 2023-2027 period, the company plans to invest $40 billion, with significant allocations for Sempra California, Sempra Texas Utilities, and Sempra Infrastructure, propelling its growth trajectory.

Robust Solvency and Price Performance

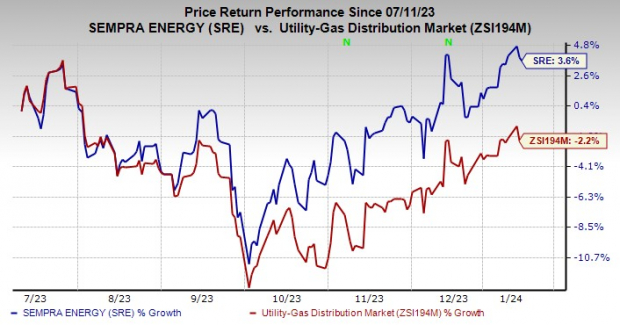

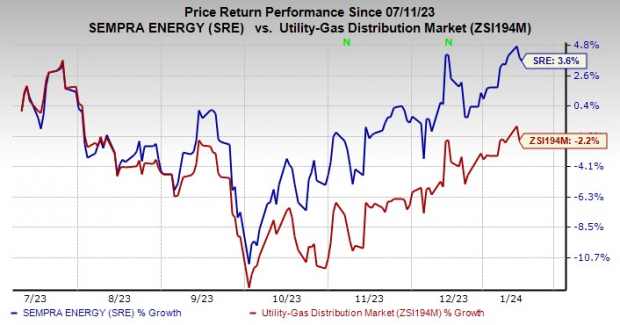

Sempra Energy’s times interest earned ratio (TIE) at the end of the third quarter of 2023 stood at 2.9, indicating the company’s capability to meet its interest payment obligations without any concerns. Additionally, SRE’s share price has outperformed its industry, registering a 3.6% increase in the past month versus the industry’s average decline of 2.2%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks in the same sector include AtmosEnergy ATO, American Water AWK, and Entergy ETR, each currently holding a Zacks Rank #2. These stocks present compelling investment opportunities alongside Sempra Energy.

Atmos Energy’s long-term earnings growth rate is pegged at 7.26%, American Water at 7.76%, and Entergy at 6.43%, making them worthy candidates to consider for a diversified investment portfolio.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion. As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Sempra Energy (SRE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.