**PG&E Corporation (PCG) Plans Significant Investments for Clean Energy and Growth**

PG&E Corporation has announced plans to invest approximately $12.9 billion in 2025 and an additional $73 billion from 2026 to 2030, targeting a 10% earnings growth for 2025 and a long-term annual growth rate of at least 9%. The company aims to achieve a renewable energy target of 90% for retail sales by 2035, with a storage goal of 580 megawatts operational by the end of 2024. The Zacks Consensus Estimate projects earnings per share of $1.50 for 2025 and $1.64 for 2026, reflecting year-over-year growth of 10.29% and 9.05%, respectively.

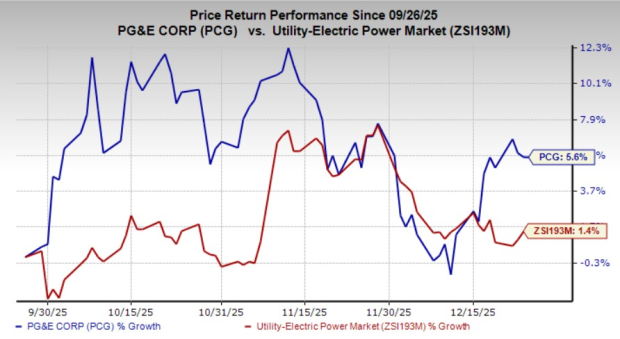

In addition, PG&E reports a current dividend yield of 1.26% and a dividend payout ratio of 7% for 2025, expected to increase to 20% by 2026-2030. The company’s return on equity (ROE) stands at 11.10%, exceeding the industry average of 9.60%. The utilities sector has shown positive trends, with PG&E’s stock gaining 5.6% over the past three months, outperforming the industry’s 1.4% growth.