Netflix (NFLX) released its quarterly earnings report on [Insert Date], revealing an earnings per share (EPS) of $0.56, slightly surpassing the expected $0.55, and a revenue of approximately $12.05 billion, above forecasts. The company reported over 325 million paid subscribers worldwide. Despite this positive performance, Netflix shares fell over 4% due to softer first-quarter guidance and investor concerns regarding acquisition costs related to Warner Bros. Discovery.

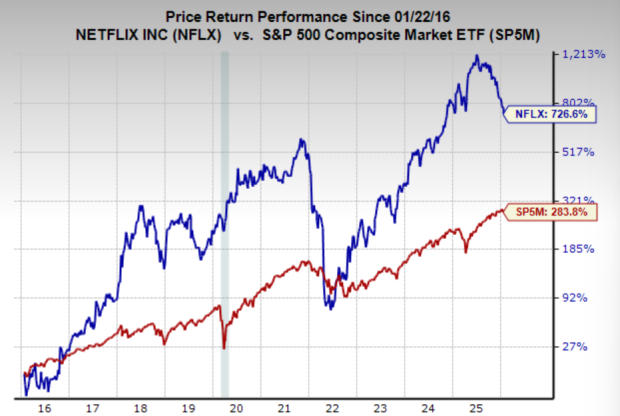

Management projects full-year 2026 revenue between $50.7 billion and $51.7 billion, fueled by growing ad revenue. Historically, Netflix has provided significant returns, compounding at 23.4% annually over the last decade. The stock currently trades at roughly 27.2 times forward earnings, a noticeable discount to its five-year median of 37.1 times.

Looking ahead, Netflix aims to double its revenue by 2030 and pursue a $1 trillion market capitalization. To achieve this, the company is expanding its content strategy beyond scripted material and incorporating international programming, live events, gaming, and advertising.