Charles River Laboratories International, Inc. CRL is well-poised for the coming quarters, on the back of its impressive strategic acquisitions. Stabilization of demand trends within the DSA (Discovery and Safety Assessment) arm is encouraging. The company’s sound solvency also instils optimism. However, concerns remain over the adverse impacts of macroeconomic challenges as well as currency fluctuations.

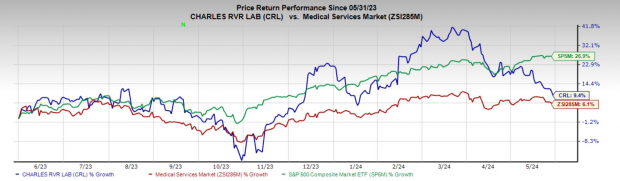

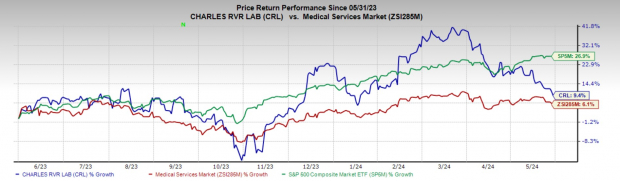

In the past year, this Zacks Rank #3 (Hold) company’s shares have risen 9.4% compared with 6.1% growth of the industry. The S&P 500 composite has increased 26.9% during the same time frame.

Operating as a full-service, early-stage contract research organization, Charles River has a market capitalization of $11.05 billion. CRL’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.92%.

Let’s delve deeper.

Upsides

Strategic Acquisitions Drive Growth: Charles River has expanded its products and services offerings across the drug discovery and early-stage development continuum through focused acquisitions. Within DSA, the additions of Retrogenix and Vigene Biosciences are presently contributing strongly to the company’s top line.

Within RMS, CRL acquired a 41% additional stake in Mauritius-based NHP provider Noveprim in November 2023. This acquisition has led to a 90% controlling interest in Noveprim, firmly supporting Charles River’s NHP supply strategy. The addition of Explora Biolabs in April 2022 complements the company’s existing Insourcing Solutions business, specifically its CRADL footprint, and offers incremental opportunities to partner with an emerging client base.

Image Source: Zacks Investment Research

DSA Arm Thrives: CRL is gaining from its extensive expertise in the discovery of preclinical candidates and in the design, execution and reporting of safety assessment studies for numerous types of compounds, including cell and gene therapies and small and large molecule pharmaceuticals. Despite a decline in the DSA organic revenues in the first quarter, demand trends continued to stabilize.

Following a soft first quarter, study volume is expected to improve. Currently, Charles River awaits the final impact of the BIOSECURE Act on the broader biopharmaceutical industry. If the bill gets passed, Charles River expects the potential impact to be a net positive, given the company has approximately 95% of its revenue base in North America and Europe.

Stable Solvency Structure: Charles River exited the first quarter of 2024 with cash and cash equivalents of $327 million compared with $277 million and no short-term payable debt on its balance sheet. Meanwhile, total debt was $2.66 billion compared with $2.65 billion at the end of 2023.

Downsides

Foreign Exchange Translation Impacts Sales: Foreign exchange is a major headwind for Charles River as a considerable percentage of its revenues comes from outside the United States. The strengthening of the euro and some other developed market currencies has been constantly hampering the company’s performance in the international markets.

Macroeconomic Condition: Charles River’s RMS and DSA businesses face potential challenges in China due to the U.S-China related tensions. Additionally, the Manufacturing Solutions segment is experiencing softness across the broader end markets, which according to the company, is due to a post-COVID slowdown from biopharma manufacturers, CDMOs and their suppliers.

In Microbial Solutions, the global biopharma demand environment is affecting the Endosafe endotoxin testing product line as clients are reducing both testing volumes and investments in new instruments. At the end of the first quarter of 2024, CRL recognized similar destocking activities.

Estimate Trend

The Zacks Consensus Estimate for 2024 earnings has moved down 0.1% to $11.00 per share in the past 30 days.

The Zacks Consensus Estimate for 2024 revenues is pegged at $4.21 billion, which implies a 2% increase from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and ResMed RMD.

Hims & Hers Health’s earnings are expected to surge 263.6% in 2024 compared with the industry’s 16.9%. HIMS’ earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 79.2%. Its shares have risen 119.1% against the industry’s 27% decline in the past year.

HIMS sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace, also sporting a Zacks Rank #1 at present, has an estimated 2024 earnings growth rate of 27.1% compared with the industry’s 12.8%. Shares of MEDP have rallied 91.2% compared with the industry’s 6.8% growth over the past year.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

ResMed, carrying a Zacks Rank #2 (Buy) at present, has an estimated fiscal 2024 earnings growth rate of 18.6% compared with the industry’s 12.6%. Shares of RMD have lost 1% against the industry’s 3.8% growth over the past year.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.