Clean Harbors has been on a roll, with its stock soaring by 43.4% in the past year, outstripping the industry it is a part of and even surpassing the Zacks S&P 500 Composite’s growth. The company boasts an impressive Growth Score of A, reflecting a robust foundation for further expansion and sustainability.

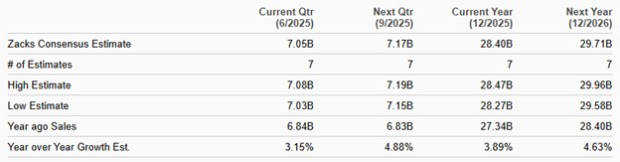

Projections suggest that CLH’s earnings are set to increase by 5.2% and 15.6% year over year in 2024 and 2025, respectively. Furthermore, revenues are expected to climb by 5.2% in 2024 and 5% in 2025, indicative of a positive growth trajectory.

Optimistic Signs Ahead

Clean Harbors’ growth is primarily fueled by strategic acquisitions. The recent addition of HEPACO in 2024 has unlocked new markets and customer segments, enhancing the company’s capabilities in transportation services. Similarly, the acquisition of Thompson Industrial Services in 2023 and other strategic purchases in 2022 have fortified CLH’s presence in various sectors, bolstering its operations.

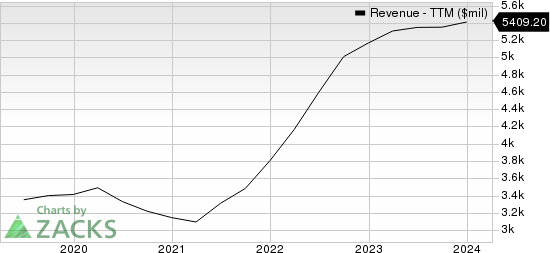

Steady Revenue Growth

Clean Harbors, Inc. revenue-ttm | Clean Harbors, Inc. Quote

Furthermore, CLH’s commitment to quality, regulatory compliance, and ongoing capital investments is evident. The company’s planned expansion of the Baltimore site in 2024 underscores its dedication to enhancing recycling capabilities and catering to evolving customer needs.

Notably, Clean Harbors’ consistent share repurchase program has resonated well with investors, instilling confidence and positively impacting the company’s financial position. Over the past few years, CLH has repurchased shares worth millions, reinforcing its commitment to maximizing shareholder value.

Potential Risks to Consider

Despite its promising outlook, Clean Harbors faces challenges such as rising selling, general, and administrative expenses, which could impact profitability in the near term. Additionally, fluctuations in the company’s current ratio are signals that warrant careful monitoring to ensure financial stability.

Stock Analysis and Recommendations

With a current Zacks Rank #3 (Hold), Clean Harbors remains an intriguing prospect for investors seeking exposure to the business services sector. For those looking for alternative options, companies like HNI Corporation (HNI) and Barrett Business Services (BBSI) present compelling opportunities to explore.

HNI holds a Zacks Rank of 1 (Strong Buy) with a promising long-term earnings growth projection, while BBSI secured a Zacks Rank of 2 (Buy) and boasts a notable track record in exceeding earnings expectations.

Zacks Names #1 Semiconductor Stock

Amidst the hustle and bustle of the market, a promising semiconductor stock emerges, paving the way for potential growth and innovation in the realm of Artificial Intelligence, Machine Learning, and Internet of Things. As the global semiconductor industry is poised for exponential growth, seize the opportunity to ride this wave of advancement.

Explore This Stock Now for Free >>

Read more about Clean Harbors, Inc. (CLH) here on Zacks.com.

Discover more insights from Zacks Investment Research

Please note that the content of this article reflects the views of the author and not necessarily those of Nasdaq, Inc.