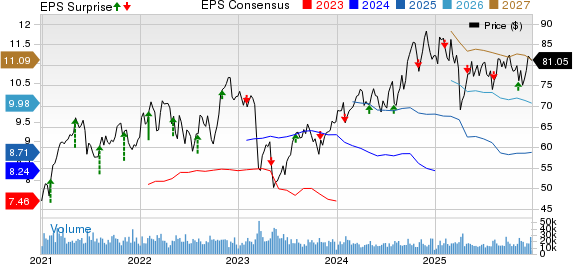

MetLife, Inc. (MET), a global financial services company with a market capitalization of $53.4 billion, reported a 2.4% increase in total premiums year-over-year during the first nine months of 2025, driven by growth in its Group Benefits, Asia, and EMEA segments. The Zacks Consensus Estimate for MetLife’s 2025 earnings is $8.71 per share, reflecting a 7.4% rise, with anticipated revenues of $79.1 billion—an 8.3% year-over-year increase.

As of September 30, 2025, MetLife held $20.2 billion in cash and cash equivalents against a short-term debt of $378 million, supporting its shareholder return strategy through share repurchases and dividends, currently yielding 2.8%. The company aims for a 100-basis point reduction in unit costs by 2025 to enhance operational efficiency.

However, the company faces challenges, including a significant 72.9% decrease in variable investment income in 2023, which fell short of targets. MetLife’s return on invested capital (ROIC) stands at 1.8%, below the industry average of 2.1%, highlighting concerns over capital efficiency.