Brisk Strides in an Uncertain Terrain

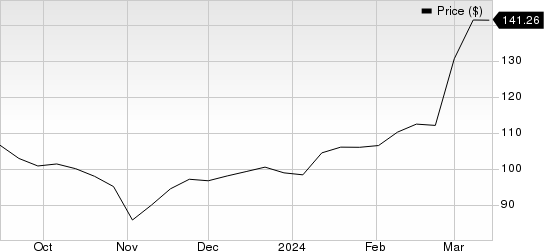

Charles River Associates, affectionately known as CRAI, has been on a dazzling ascent over the last half-year. The stock has surged by 32.5%, leaving its industry’s modest 20.5% growth and the Zacks S&P 500 composite’s 15.1% jump in the dust.

With a stellar Growth Score of A, CRAI encapsulates the essence of growth, a crucial metric derived from a company’s financials to gauge the veracity and sustainability of its progress.

A Glimpse into the Future

The Zacks Consensus is sparkling for CRAI’s 2024 earnings at $5.7, hinting at a 3.7% year-over-year bump. Beyond this, the company exhibits a long-term anticipated earnings growth rate of 16%.

Charles River Associates Price Movement

Charles River Associates price | Charles River Associates Quote

Building a Fortress of Strength

Diversification is the bedrock of Charles River’s business, manifesting through a spectrum of services across functional expertise, client demographics, and global regions. This multi-industry prowess enables the company to cater to diverse client requirements and introduce innovative services. Moreover, its amalgamation of experts from various fields creates a harmonious nexus. Diversification stands as a bulwark, shielding the enterprise against dependence on any singular market, domain, or geographic area, fortifying its resilience to dynamic shifts.

Nurturing shareholder wealth creation is the ethos Charles River imbues, offering a dependable avenue for long-term wealth multiplication. Resolute in its commitment, the company repurchased shares worth $31.4 billion, $27.6 million, and $45 million in 2023, 2022, and 2021, respectively. Dividend payouts in the same period totaled $10.8 million, $9.6 million, and $8.3 million.

At the closing of the fourth quarter of 2023, Charles River boasted a current ratio of 1.12, an improvement from the 1.11 in the preceding quarter. A ratio exceeding 1 indicates a healthy capacity to meet short-term obligations.

Challenges on the Horizon

Not all roses bloom without thorns – the escalating talent costs in a cutthroat consulting services industry have posed a challenge for firms like Charles River. The labor-intensive nature of the industry, coupled with its reliance on foreign talent, exacerbates these fiscal strains. Furthermore, the advent of automation and artificial intelligence, while brimming with potential, begets ambiguity as clients navigate new avenues for performance enhancement.

Expert Analysis and Promising Alternatives

Presently holding a Zacks Rank #3 (Hold), Charles River stands at a crossroads of growth.

In the broader spectrum of Zacks Business Services, standouts like Block SQ and APi Group APG beckon. Block claims a commendable Zacks Rank of 1 (Strong Buy), while SQ forecasts a robust long-term earnings growth of 33%, accompanied by a consistent trailing four-quarter earnings surprise of 10.8% on average.

APi Group strides with a Zacks Rank of 2, anticipating a sturdy long-term earnings growth of 17.9%, buoyed by a steady trailing four-quarter earnings surprise averaging 5.1%.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.