Stanley Black & Decker, Inc. SWK is thriving in the engineered fastening business despite a decrease in consumer outdoor and DIY market demand, and rising expenses.

Let’s delve into the reasons investors ought to hold onto this stock for the time being.

Growth Catalysts

Business Strength: The solid momentum in the engineered fastening business, fueled by aerospace and auto end markets, is bolstering the company’s performance in this sector. Stanley Black’s global cost-reduction initiative is poised to enhance its profitability and boost margins in the upcoming quarters. Efforts to eliminate or reduce overlapping functions and capabilities are in full swing. The company is restructuring operations to ensure resources are optimally allocated to core businesses.

By the end of 2023, the company achieved pre-tax run rate savings of $835 million through its global cost-reduction program. Anticipated run rate savings of $1.5 billion by the close of 2024 and $2 billion by 2025 are on the horizon. Initiatives like supply-chain optimization and inventory reduction are also expected to contribute to margin growth. Stanley Black reduced its inventory by $1.1 billion in 2023 and aims to achieve adjusted gross margins exceeding 30% by 2024.

Focus on Core Operations: The company’s divestment of non-core operations is geared towards driving growth. In December 2023, Stanley Black signed an agreement to sell its STANLEY Infrastructure business to Epiroc AB for $760 million. This divestiture enables the company to concentrate on its core businesses while aligning with its capital-allocation strategy. The sales proceeds, net of taxes, are earmarked for debt reduction. Approval of the deal is contingent on regulatory green lights and standard closing formalities.

In July 2022, the divestiture of the Security Business to Securitas AB for $3.2 billion in cash marked another strategic move. The net proceeds from this sale were used to trim debt. In the same month, the Automatic Doors business was sold to Allegion for $900 million. These divestments underscore Stanley Black’s commitment to focusing on its core businesses. Furthermore, in June 2022, a deal was struck to sell the STANLEY oil & gas division to Pipeline Technique Limited, empowering Stanley Black to effectively allocate resources to the Industrial, and Tools & Outdoor segments.

Rewards to Shareholders: The company’s dedication to rewarding shareholders through dividend payouts is commendable. In 2023, dividends totaling $482.6 million were disbursed, marking a 3.6% increase year over year. Share repurchases amounting to $16.1 million were also made during the period. In July 2023, the dividend was increased by a cent to 81 cents per share, translating to $3.24 annually.

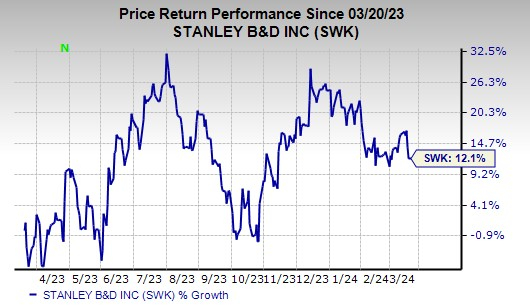

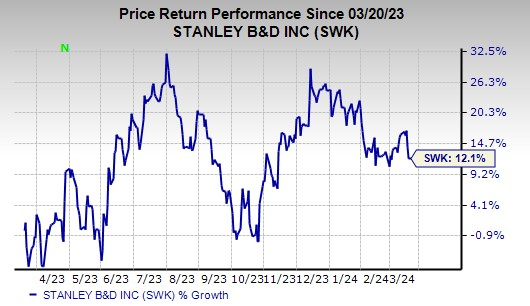

Given these positive developments, holding onto SWK stock seems prudent for now, supported by its current Zacks Rank #3 (Hold). Over the past year, the company’s shares have appreciated by 12.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some notable companies from the Industrial Products sector:

Atmus Filtration Technologies Inc. ATMU, holding a Zacks Rank #1 (Strong Buy), boasts an average trailing four-quarter earnings surprise of 20.3%. View the complete roster of today’s Zacks #1 Rank stocks here.

ATMU’s 2024 earnings estimates have climbed 2.9% in the past 60 days. The company’s stock has surged by 20.7% in the last year.

Tetra Tech, Inc. TTEK, currently with a Zacks Rank #2 (Buy), has an average trailing four-quarter earnings surprise of 14.4%.

Estimates for TTEK’s fiscal 2024 earnings have risen by 2.9% in the last 60 days. The stock has experienced a 26.8% growth over the past year.

Applied Industrial Technologies, Inc. AIT holds a Zacks Rank of 2 with an average trailing four-quarter earnings surprise of 10.4%.

The consensus estimate for AIT’s fiscal 2024 earnings has gone up by 1.7% in the last 60 days. Over the past year, the stock has seen a 41.5% increase.

Infrastructure Stock Boom to Sweep America

A significant effort to revamp the deteriorating U.S. infrastructure is on the horizon. It’s a bipartisan, pressing, and unavoidable task. Trillions will be invested, fortunes will be made.

The big question is, “Will you be early in picking the right stocks when their growth potential is at its peak?”

Zacks has issued a Special Report to assist you in doing just that, and today, it’s complimentary. Explore 5 distinct companies set to benefit the most from the massive infrastructural development and renovation of roads, bridges, buildings, as well as freight operations and energy transformation on an immense scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? You can download 7 Best Stocks for the Next 30 Days today.

To read this article on Zacks.com click here.

Zacks Investment Research