Avantor, Inc. AVTR is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism led by solid first-quarter 2024 results and operational workflow also looks promising. However, headwinds resulting from the loss of a significant number of customers and regulatory requirements are major downsides.

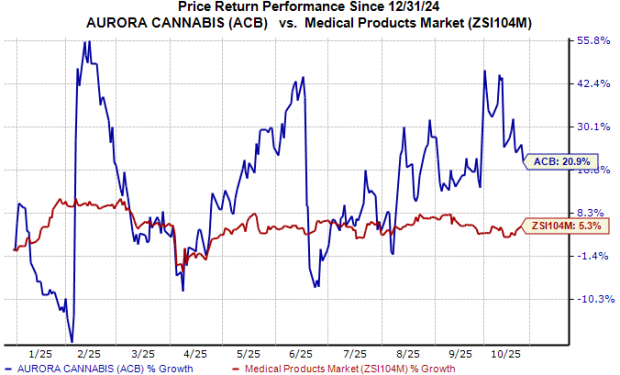

Over the past year, this Zacks Rank #3 (Hold) stock has rallied 18.2% compared with the 4.5% rise of the industry and the 26% growth of the S&P 500.

The renowned provider of mission-critical products and services has a market capitalization of $16.01 billion. The company projects 9.7% growth for the next five years and expects to witness continued improvements in its business. Avantor surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed the same in one and broke even once, delivering an earnings surprise of 5.1%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Upsides

Strong Q1 Results: Avantor’s management confirmed that in the first quarter of 2024, the company’s bioprocessing end market in Bioscience Production remained healthy with a robust pipeline of new therapies, a favorable regulatory landscape (including three new cell and gene therapy approvals in the quarter) and strong patient demand. AVTR also saw sequential improvement in its bioprocessing order rate.

Operational Workflow: We are optimistic about Avantor’s more than 200 facilities strategically located worldwide, including manufacturing, distribution, service, research & technology and sales centers. The company operates more than 45 global manufacturing facilities, including 19 facilities that are current Good Manufacturing Practice (cGMP) compliant and have been registered with the FDA or comparable foreign regulatory authorities.

Product Portfolio: We are optimistic about Avantor’s portfolio, which includes a comprehensive range of products and services that allow it to create customized and integrated solutions for its customers. On the first-quarter 2024earnings callin April, management confirmed that Avantor enhanced its offerings for cell engineering, gene therapy and synthetic biology applications via supplier partnerships and proprietary innovation as part of its innovation strategy.

Downsides

Loss of a Significant Number of Customers: Avantor’s operating results could be adversely affected by the loss of revenues from a significant number of its customers, including direct distributors and end users. If a significant number of customers purchase fewer of its products, defer orders or fail to place additional orders with the company, its sales could decline, and its operating results may not meet its expectations.

Regulatory Requirements: Avantor develops, configures and markets its products to meet customer needs driven by those regulations. It is subject to laws and regulations concerning cGMP and product safety. The company’s subsidiaries may be required to register for permits and/or licenses and comply with the laws and regulations of the FDA and other various state and foreign agencies, as well as certain accrediting bodies. Any significant change in regulations could reduce demand for its products or increase expenses.

Estimate Trend

Avantor has been witnessing a flat estimate revision trend for 2024. Over the past 90 days, the Zacks Consensus Estimate for its earnings per share has remained stable at $1.01.

The Zacks Consensus Estimate for second-quarter 2024 revenues is pegged at $1.71 billion, which suggests a 2.2% decline from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Boston Scientific Corporation BSX and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

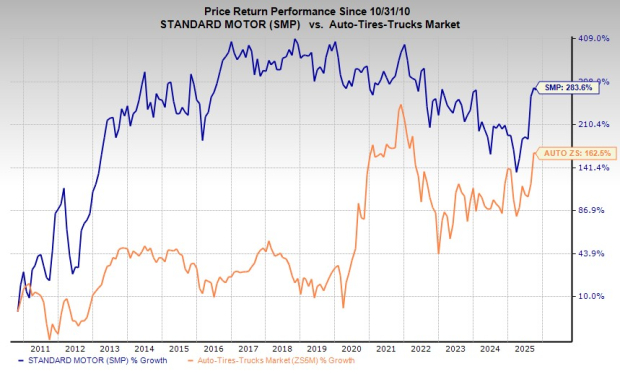

DaVita’s shares have rallied 56.5% compared with the industry’s 25.3% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average being 7.5%.

Boston Scientific has advanced 46.1% compared with the industry’s 2.9% growth in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

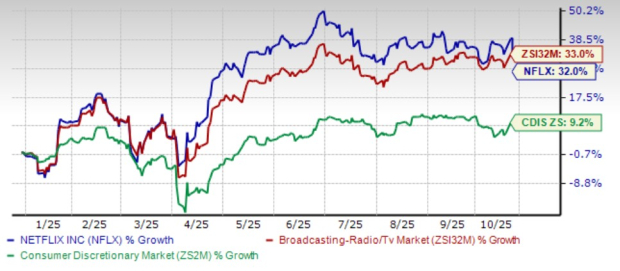

Ecolab’s shares have rallied 38.1% against the industry’s 8.5% decline in the past year.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Avantor, Inc. (AVTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.