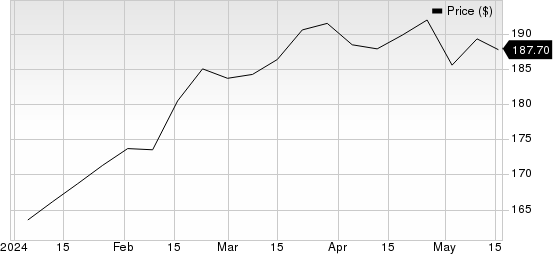

Republic Services, Inc. RSG has had an impressive run year to date. The stock has appreciated 14%, outperforming the 13.3% growth of the industry it belongs to and the 11.5% rise of the Zacks S&P 500 composite.

RSG has an impressive Growth Score of B. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of the quality and sustainability of its growth.

The company’s earnings for 2024 and 2025 are expected to grow at a rate of 7.8% and 10.6%, respectively, on a year-over-year basis.

Republic Services, Inc. Price

Republic Services, Inc. price | Republic Services, Inc. Quote

Factors That Augur Well

Being a leading waste disposal company, Republic Services is expected to continue benefiting from ongoing trends like increasing environmental concerns, rapid industrialization, increase in population and active government measures to reduce illegal dumping. The company remains focused on expanding its recycling volume through improved material handling processes and programs. RSG’s top line increased 7.8% year over year in the first quarter of 2024.

Republic Services is focused on increasing its operational efficiency and reducing fleet operating costs by shifting to compressed natural gas (CNG) collection vehicles. In 2023, around 20% of the company’s recycling and solid waste collection fleet operated on CNG and 13% of its replacement recycling and solid waste vehicle purchases were CNG vehicles.

Republic Services puts consistent efforts into rewarding its shareholders through dividend payments and share repurchases. In 2023, 2022 and 2021, it paid $650 million, $592.9 million and $552.6 million in dividends and repurchased shares worth $261.8 million, $203.5 million and $252.2 million, respectively. Such moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business. These initiatives not only instill investors’ confidence but also positively impact earnings per share.

Some Risks

Republic Services’ current ratio (a measure of liquidity) at the end of first-quarter 2024 was 0.53, lower than the prior quarter’s 0.56 and the year-ago quarter’s 0.74. A current ratio of less than 1 indicates that the company may have problems paying off its short-term obligations.

Zacks Rank and Stocks to Consider

Republic Services currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the broader Business Service sector that investors may consider:

Conduent CNDT: The company is a global provider of digital business solutions and services to commercial, government and transportation clients. It is currently focused on rationalizing its portfolio to increase revenue generation opportunities. The approach should help CNDT free up capital for the purpose of reducing debt, buying back shares and pursuing other opportunities that promise growth.

The Zacks Consensus Estimate for CNDT’s 2024 earnings has been revised 56.6% northward in the past 60 days to $1.66. CNDT currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Barrett Business Services BBSI: The company offers business management solutions tailored for small and mid-sized enterprises across the United States.

With a growing client base, it is experiencing an expansion in gross billings. The company remains buoyed by successful marketing efforts, the introduction of new products and the implementation of BBSI Benefits. With these factors driving momentum, the outlook for 2024 is optimistic, positioning it for a robust performance.

The Zacks Consensus Estimate for the company’s 2024 earnings has been revised 2.2% northward in the past 60 days to $7.95. BBSI also currently carries a Zacks Rank #2.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

Conduent Inc. (CNDT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.