Progressive Sees Growing Investor Interest Amid Competitive Auto Insurance Market

Investors have recently focused on Progressive (NYSE: PGR) due to positive figures from its first-quarter earnings report. However, this popularity comes with a price, as the company’s valuation metrics indicate it is more expensive than several major competitors.

While a premium often reflects quality, Progressive embodies this trend, making its current valuation noteworthy.

Insurance Growth in a Competitive Landscape

Progressive has shown resilience in the auto insurance sector, rebounding impressively from the pandemic’s impact. This resurgence coincides with somewhat unpopular rate increases that have swept the industry. Given the intense competition in this market, which tends to favor price sensitivity over brand loyalty, companies that innovate to generate premiums will gain a competitive advantage.

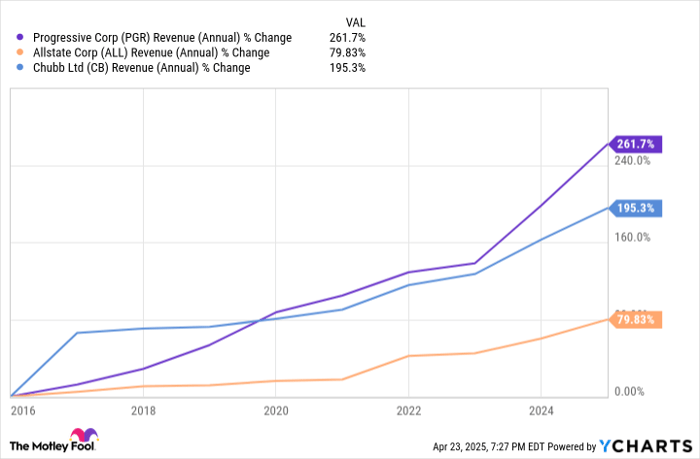

The insurer has demonstrated superior revenue growth compared to rivals like Allstate and Chubb:

PGR Revenue (Annual) data by YCharts.

Effective marketing is crucial in this industry, where products often appear similar. Progressive’s unique and humorous advertising strategies help reinforce its brand, making it more memorable for consumers.

Innovative Growth Strategies

Progressive’s management team consistently demonstrates a commitment to growth. Despite limited expansion opportunities within the auto insurance market, the recent introduction of Cargo Plus, an extension of its truck coverage, illustrates the company’s ability to adapt and innovate.

Nevertheless, investing in any insurance Stock carries inherent risks. Consumer backlash against rate hikes has been significant, limiting room for further increases. Yet, Progressive’s solid operational performance justifies its elevated valuations in the eyes of many analysts.

Evaluating an Investment in Progressive

Before considering an investment in Progressive, prospective buyers should weigh their options:

The Motley Fool Stock Advisor analyst team recently identified what they consider the 10 best stocks to buy today, and Progressive did not make that list. Those selected could yield substantial returns in the years to come.

For context, consider when Netflix was recommended on December 17, 2004… a $1,000 investment then would be worth $594,046!* Similarly, had you invested $1,000 in Nvidia on April 15, 2005, you would have seen that grow to $680,390!*

It’s important to note Stock Advisor has an average return of 872%— a significant outperformance compared to 160% for the S&P 500. Access the latest top 10 list when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 21, 2025

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Progressive. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.