Edison International Reports $45,000 in Lobbying Expenditures

Edison International disclosed $45,000 in lobbying expenses for the first quarter of 2025 in a new filing under the Lobbying Disclosure Act.

Key Lobbying Issues

The lobbying activities included efforts on various electricity-related matters, specifically:

- HR 8997/S. 4927 – FY25 Energy and Water Development Appropriations Bill

- Issues concerning the San Onofre Nuclear Generating Station (SONGS) and waste storage

- HR 10545 – FY25 Further Continuing Appropriations Act (CR through March 14, 2025)

- HR 1968 – Full-Year Continuing Appropriations and Extensions Act, 2025

- Cybersecurity Information Sharing Act

You can find more information on corporate lobbying from Quiver Quantitative.

EIX Congressional Stock Trading

Members of Congress have transacted $EIX stock two times over the past six months, with one purchase and one sale recorded.

For a detailed view of these transactions, visit Quiver Quantitative’s congressional trading dashboard.

EIX Insider Trading Activity

In the last six months, insiders at Edison International executed six trades, all being sales with no purchases reported.

Here’s a summary of insider transactions:

- Adam S. Umanoff (Executive VP, General Counsel and Corporate Secretary) sold 25,619 shares for approximately $2,127,540

- Jeanne Beliveau-Dunn sold 3,288 shares for about $178,666

- Peter J. Taylor sold 1,250 shares for an estimated $104,100

- Keith Trent sold no shares for an estimated $78

- Maria C. Rigatti (Executive VP and CFO) sold no shares for an estimated $74

- Erica S. Bowman (Vice President) sold no shares for an estimated $42

To monitor insider trading, check out Quiver Quantitative’s dashboard.

EIX Hedge Fund Activity

Recent reports indicate that 413 institutional investors added to their EIX stock holdings, while 373 reduced their positions in the latest quarter.

Some of the most significant recent hedge fund movements are:

- Pzena Investment Management LLC decreased their holdings by 3,888,326 shares (-42.0%) in Q4 2024, amounting to an estimated $310,443,947

- Atlas Infrastructure Partners (UK) Ltd. reduced shares by 3,696,431 (-71.4%) in Q4 2024, valued at approximately $295,123,051

- Canada Pension Plan Investment Board increased shares by 2,643,571 (+364.1%) in Q4 2024, totaling an estimated $211,062,708

- Northern Trust Corp added 2,016,017 shares (+53.9%) in Q4 2024, approximately costing $160,958,797

- JPMorgan Chase & Co decreased shares by 1,890,374 (-41.4%) valued at about $150,927,460

- Ameriprise Financial Inc increased their holdings by 1,673,204 shares (+149.3%) in Q4 2024, amounting to around $133,588,607

- Vanguard Group Inc added 1,559,501 shares (+3.3%) during Q4 2024, costing about $124,510,559

To view hedge funds’ stock portfolios, visit Quiver Quantitative’s institutional holdings dashboard.

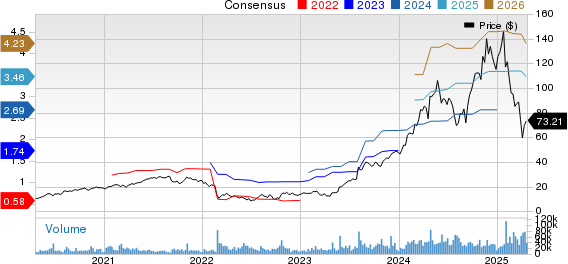

EIX Analyst Ratings

In recent months, Wall Street analysts have provided insights on $EIX, with three firms issuing buy ratings and one issuing a sell rating.

Below are some of the latest analyst ratings:

- Barclays issued an “Overweight” rating on January 23, 2025

- Jefferies rated the stock as “Buy” on January 9, 2025

- Morgan Stanley assigned an “Underweight” rating on January 9, 2025

- Wells Fargo rated it “Overweight” on October 30, 2024

To keep track of analyst ratings and price targets for $EIX, visit Quiver Quantitative’s forecast page.

EIX Price Targets

Recently, analysts have set price targets for $EIX with a median target of $77.0 over the past six months, with two analysts providing specific targets.

Recent price targets include:

- Nicholas Campanella from Barclays set a target price of $67.0 on January 23, 2025

- Gregg Orrill from UBS set a target price of $87.0 on December 19, 2024

This article is not financial advice. For more information, please refer to Quiver Quantitative’s disclaimers.

This article was originally published on Quiver News; please read the full story.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.