Lennox International Discloses $20,000 Lobbying and Insider Trading Activity

Lennox International Inc. reported $20,000 in lobbying expenditures for the first quarter of 2025, according to a recent filing under the Lobbying Disclosure Act.

Lobbying Focus Areas

The company’s lobbying efforts have centered on several key issues, including:

- Monitoring matters related to energy efficiency for residential and commercial HVACR products.

- Addressing tax policy and tax reform issues.

- Tracking developments concerning the Kigali Amendment to the Montreal Protocol and associated legislation aimed at phasing down HFC refrigerants.

For more insights into corporate lobbying, visit Quiver Quantitative.

Insider Trading Activities at Lennox International

In the past six months, insiders at Lennox International have conducted 13 stock transactions, all of which were sales with no purchases reported.

Below is a summary of significant insider trades:

- JOHN D TORRES (Executive Vice President) executed 4 sales, totaling 2,368 shares for an estimated $1,401,800.

- PRAKASH BEDAPUDI (EVP, Chief Technology Officer) sold 965 shares, earning approximately $596,370.

- JOSEPH NASSAB (EVP & President, Building Climate Solutions) made 3 sales totaling 643 shares for an estimated $398,090.

- TODD J TESKE sold 500 shares, valued at approximately $337,760.

- SHERRY BUCK sold 500 shares for an estimated $330,370.

- CHRIS KOSEL (VP-Corp Controller and CAO) made 2 sales totaling 394 shares for around $250,072.

- SHANE D WALL sold 325 shares, earning approximately $199,215.

To keep up with insider trades, check Quiver Quantitative’s trading dashboard.

Hedge Fund Movements

Recent data indicates that 314 institutional investors have increased their positions in Lennox International, while 272 have decreased their holdings during the latest quarter.

Significant institutional moves include:

- BLACKROCK, INC. divested 775,562 shares (-21.3%) in Q4 2024, valued at approximately $472,549,926.

- VANGUARD GROUP INC added 643,988 shares (+19.9%) in Q4 2024, worth an estimated $392,381,888.

- BEACON POINTE ADVISORS, LLC purchased 435,548 shares (+inf%) during Q4 2024, valued at around $265,379,396.

- GEODE CAPITAL MANAGEMENT, LLC increased its stake by 317,937 shares (+55.7%) in Q4 2024, worth approximately $193,719,014.

- CAPITAL INTERNATIONAL INVESTORS added 268,692 shares (+34.9%) during the same period, valued at about $163,714,035.

- SEVEN POST INVESTMENT OFFICE LP removed 247,076 shares (-100.0%) in Q4 2024, worth around $150,543,406.

- INVESCO LTD. acquired 236,020 shares (+90.7%) valued at approximately $143,806,986.

For a detailed look at hedge fund portfolios, visit Quiver Quantitative’s institutional holdings dashboard.

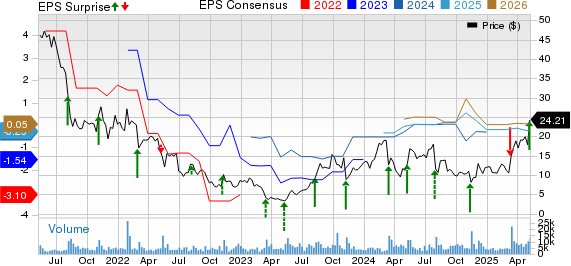

Analyst Ratings and Price Targets for Lennox International

In recent months, Wall Street analysts have evaluated Lennox International’s stock. So far, no firms have issued buy ratings, while one firm issued a sell rating.

Recent analyst reports include:

- Wells Fargo assigned an “Underweight” rating on February 3, 2025.

To track analyst ratings and price targets for Lennox International, check Quiver Quantitative’s forecast page.

Recent Price Targets

Over the last six months, four analysts have announced price targets for Lennox International, with a median target of $621.5.

Some of the recent targets include:

- Joseph O’Dea from Wells Fargo set a target price of $580.0 on February 3, 2025.

- Brett Linzey from Mizuho Securities set a target price of $675.0 on October 24, 2024.

- Deane Dray from RBC Capital set a target price of $619.0 on October 24, 2024.

- Julian Mitchell from Barclays set a target price of $624.0 on October 24, 2024.

This article is not financial advice. For more information, check Quiver Quantitative’s disclaimers.

This article was originally published on Quiver News; read the full story.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.