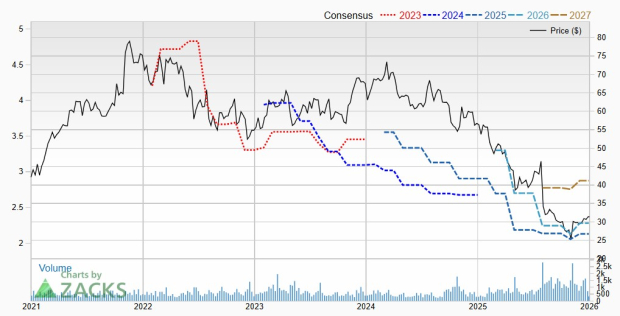

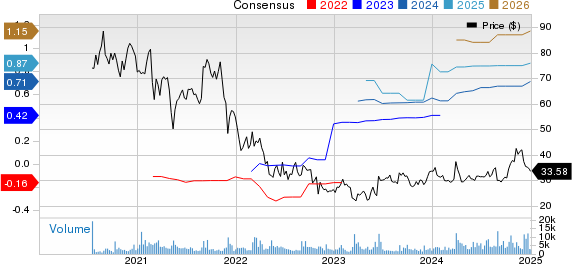

Recursion Pharmaceuticals (NASDAQ:RXRX) has experienced a 27% drop in its share price year-to-date, currently trading over 55% below its 52-week high of $12 as of July 6, 2025. Despite these challenges, the company is notable for its AI-driven drug discovery platform, Recursion OS, which integrates large-scale data collection and machine learning.

The company reported a net loss of $575 million over the last four quarters, indicating a net margin of -961% and an operating cash flow margin of -650%. However, it maintains a strong financial position with minimal debt of $93 million against a market cap of $2.1 billion and $500 million in cash, representing 38.3% of its total assets. Recursion OS is licensed to partners like Roche and Genentech, enhancing revenue streams and the platform’s commercial viability.

Investing in Recursion carries risks including potential clinical trial failures and financial sustainability concerns, given its cash burn rate. While the company’s pipeline, bolstered by a merger with Exscientia, shows promising sales potential exceeding $1 billion, successful commercialization remains uncertain as Recursion navigates regulatory hurdles and competitive pressures.