Red Rock Resorts, Inc. RRR reported mixed first-quarter 2024 results, with earnings beating the Zacks Consensus Estimate and revenues missing the same. The top line increased year over year, while the bottom line declined from the prior-year quarter’s figure. Following the results, the company’s shares fell 4.3% during the after-hour trading session on May 7.

Earnings & Revenues

In the quarter under review, adjusted earnings per share (EPS) came in at 68 cents, outpacing the Zacks Consensus Estimate of 50 cents. In the prior-year quarter, it recorded an adjusted EPS of 75 cents.

Quarterly revenues of $488.9 million missed the Zacks Consensus Estimate of $489 million. The top line rose 12.7% on a year-over-year basis. The upside was backed by strong visitation and play in local, regional and national segments. Also, strong spend per visit (on the majority of card-to-play options) added to the positives.

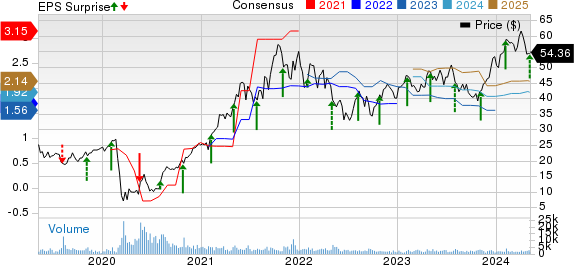

Red Rock Resorts, Inc. Price, Consensus and EPS Surprise

Red Rock Resorts, Inc. price-consensus-eps-surprise-chart | Red Rock Resorts, Inc. Quote

Las Vegas Operations

During first-quarter 2024, revenues from Las Vegas operations totaled $485.6 million, up 12.9% from $430 million in the prior-year quarter. Our projection was $481 million. Adjusted EBITDA was $229.8 million, up 7.3% year over year.

Operating Highlights

During the first quarter, selling, general and administrative expenses came in at $104.8 million compared with $92.5 million reported in the prior-year quarter. Our model estimated the metric at $105.5 million.

Net income during the quarter came in at $78.4 million compared with $85.5 million reported in the prior-year quarter. Our model estimated the metric at $87.1 million.

Adjusted EBITDA in the first quarter came in at $209.1 million compared with $194.2 million reported in the prior-year quarter. Our model estimated the metric at $212.1 million.

Other Financial Details

As of Mar 31, 2024, Red Rock Resorts had cash and cash equivalents of $129.7 million compared with $137.6 million as of Dec 31, 2023.

Outstanding debt at the first-quarter end was $3.5 billion compared with $3.4 billion in the preceding quarter.

Zacks Rank

Red Rock Resorts currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Consumer Discretionary Releases

Boyd Gaming Corporation BYD reported mixed first-quarter 2024 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. The top and the bottom line declined on a year-over-year basis.

During the quarter, the company’s performance was impacted by January’s severe winter weather in the Midwest and South and a softer Las Vegas locals market. The combined effect of these challenges fell within the anticipated range, aligning with earlier projections of $20-$25 million in EBITDAR for 2024.

Royal Caribbean Cruises Ltd. RCL reported stellar first-quarter 2024 results, with earnings and revenues beating the Zacks Consensus Estimate. The top and the bottom line increased on a year-over-year basis.

RCL benefited from robust demand, strong pricing (on closer-in demand) and solid onboard spending. The company also raised its 2024 adjusted EPS guidance on the back of an exceptional WAVE season and continued strong demand.

Hilton Worldwide Holdings Inc. HLT reported solid first-quarter 2024 results, with earnings and revenues beating the Zacks Consensus Estimate and rising year over year.

The company’s performance was backed by notable improvements in revenue per available room (RevPAR), attributed to higher occupancy rates and average daily rates (ADR). It also benefited from its fee-based business model and robust development initiatives. HLT maintained its momentum in signings, starts and openings, reflecting a solid pipeline. Based on the growth trajectory observed thus far, the company is optimistic about sustaining the momentum in the near future.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Red Rock Resorts, Inc. (RRR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.