Redburn Atlantic Boosts Thermo Fisher Scientific with a Buy Rating

On October 14, 2024, Redburn Atlantic started covering Thermo Fisher Scientific (LSE:0R0H) with a strong Buy recommendation.

Analyst Price Forecast Projects 10.62% Growth

The average one-year price target for Thermo Fisher Scientific, as of September 25, 2024, stands at 661.21 GBX/share. Predictions vary, with estimates ranging from a low of 570.25 GBX to a high of 804.78 GBX. The average target indicates a potential increase of 10.62% from its latest closing price of 597.75 GBX/share.

Company Revenue on the Rise

Projected annual revenue for Thermo Fisher Scientific is 49,548MM, reflecting a robust increase of 17.01%. Additionally, the expected annual non-GAAP EPS is 27.01.

Institutional Investor Sentiment

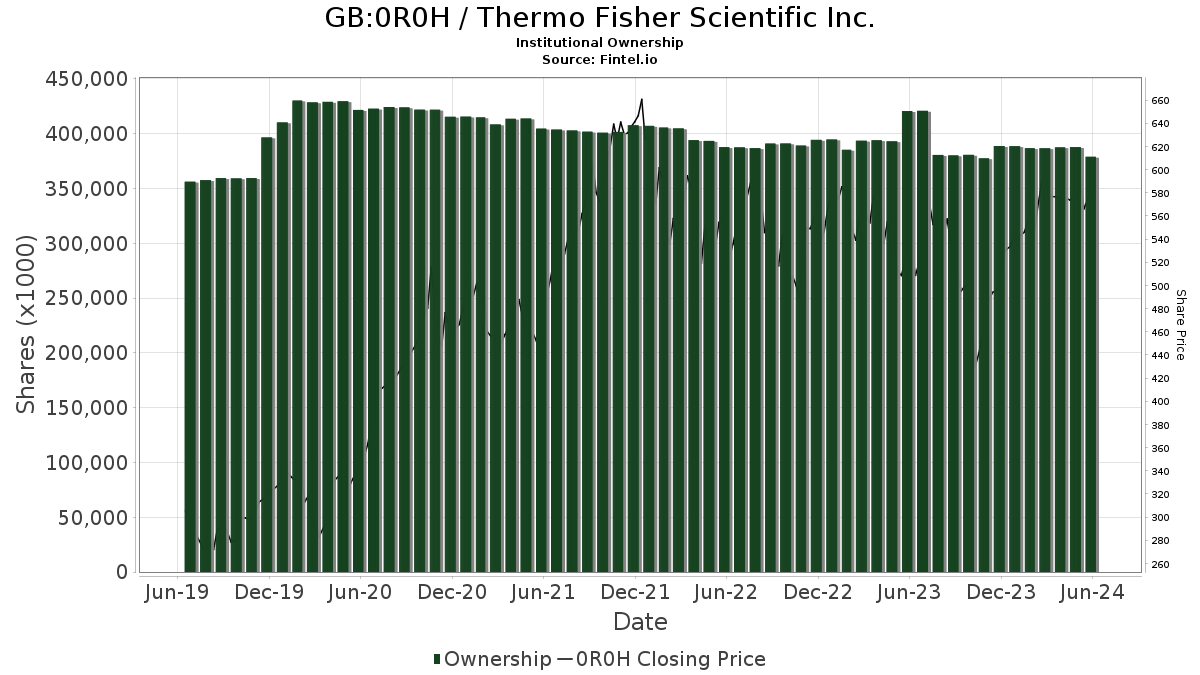

A total of 3,883 funds or institutions have reported positions in Thermo Fisher Scientific. This marks an increase of 59 owners, or 1.54%, over the last quarter. The average portfolio weight of all funds in 0R0H is now at 0.67%, which is up by 6.81%. Total shares held by institutions rose by 4.94% in the past three months, now totaling 385,277K shares.

Institutional Movements Among Major Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 12,062K shares, representing 3.16% ownership. Previously, the firm reported owning 11,987K shares, marking a 0.62% increase, although it decreased its portfolio allocation in 0R0H by 6.90% last quarter.

Price T Rowe Associates has 9,925K shares, equating to 2.60% ownership. This is a 1.30% decrease from 10,055K shares in its last filing, with an 8.30% reduction in its portfolio allocation in 0R0H over the quarter.

VFINX – Vanguard 500 Index Fund Investor Shares now holds 9,797K shares, which is 2.56% ownership, up from 9,737K shares, reflecting a 0.62% increase. However, the firm decreased its portfolio allocation in 0R0H by 9.37% during the last quarter.

Capital World Investors owns 9,518K shares (2.49% ownership), down from 13,494K shares, which is a significant 41.77% decrease. Its portfolio allocation in 0R0H also dropped by 33.87% last quarter.

Capital Research Global Investors holds 8,237K shares, translating to 2.16% ownership, showing a slight 1.51% increase from the previous count of 8,113K shares. Still, the firm reduced its portfolio allocation in 0R0H by 6.31% recently.

Fintel is a leading investment research platform providing valuable insights for individual investors, traders, financial advisors, and small hedge funds. With a wide array of data—including fundamentals, analyst reports, ownership data, and sentiment metrics—Fintel supports informed decision-making.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.