Air Products and Chemicals Receives Positive Outlook Upgrade

Fintel reports that on October 25, 2024, Redburn Atlantic upgraded their outlook for Air Products and Chemicals (NYSE: APD) from Sell to Neutral.

Analysts Predict Modest Price Increase

As of October 22, 2024, the average one-year price target for Air Products and Chemicals stands at $333.31 per share. Predictions vary, with a low target of $257.55 and a high of $404.25. This average price target suggests a potential increase of 4.85% from the company’s latest reported closing price of $317.90 per share.

Check our leaderboard to see companies with the highest price target upside.

The projected annual revenue for Air Products and Chemicals is $15.747 billion, reflecting a significant growth of 30.09%. Furthermore, the projected annual non-GAAP EPS is $14.32.

Funds Show Mixed Sentiment Towards Air Products

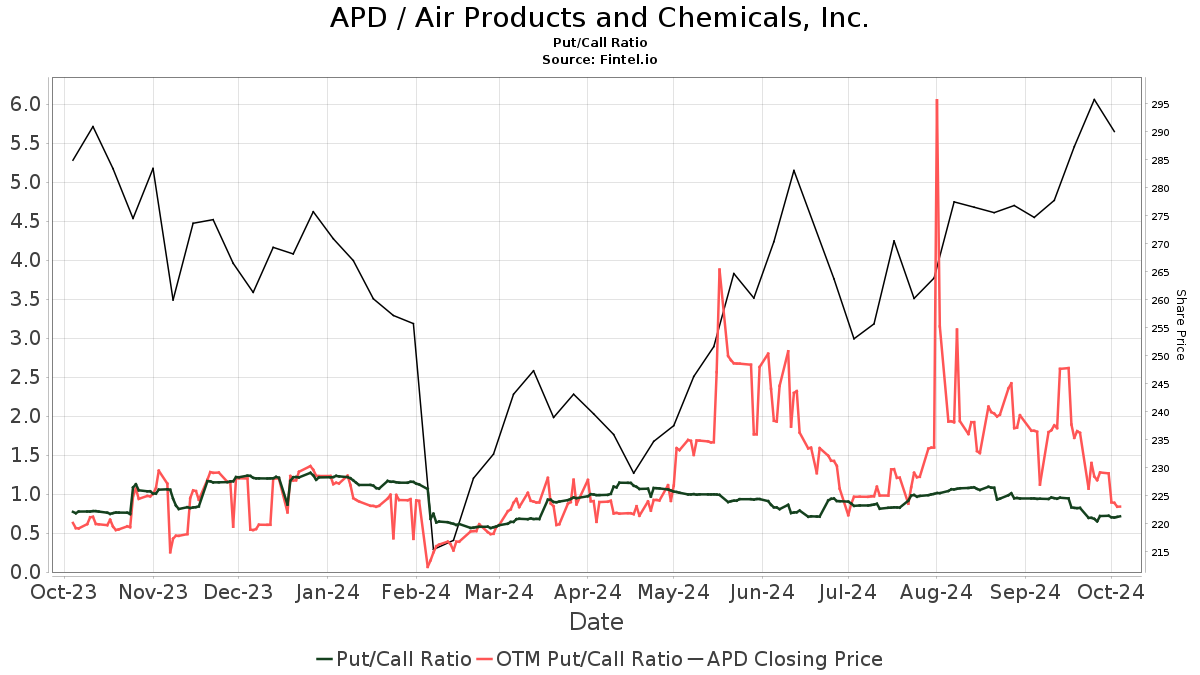

Currently, there are 2,435 funds or institutions reporting positions in Air Products and Chemicals. This marks a decrease of 54 owners, or 2.17%, over the last quarter. The average portfolio weight of all funds dedicated to APD has risen to 0.39%, representing an increase of 6.77%. Institutional ownership rose by 5.76% in the past three months, totaling 229.057 million shares.  The put/call ratio for APD is currently at 0.83, suggesting a generally bullish outlook.

The put/call ratio for APD is currently at 0.83, suggesting a generally bullish outlook.

Institutional Holdings and Changes

Capital Research Global Investors owns 14.933 million shares, which is 6.72% of the company. Their previous filing indicated ownership of 11.230 million shares, translating to an increase of 24.80%. The firm raised its portfolio allocation in APD by 37.36% over the last quarter.

State Farm Mutual Automobile Insurance holds a steady 12.302 million shares, representing 5.53% ownership, showing no change in the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) currently holds 7.028 million shares, equating to 3.16% ownership. This marks a slight increase from 6.997 million shares reported previously, a change of 0.44%. The firm has bolstered its allocation in APD by 4.03% over the last quarter.

JPMorgan Chase has reported ownership of 6.489 million shares, or 2.92%. This is a decrease from their previous holding of 6.872 million shares, representing a 5.90% reduction. Their portfolio allocation in APD dropped by 2.33%.

The Vanguard 500 Index Fund Investor Shares (VFINX) has increased its holdings to 5.705 million shares, now holding 2.57%. This reflects an increase from their last report of 5.602 million shares, or a growth of 1.81%, with a portfolio increase of 2.69% last quarter.

About Air Products & Chemicals

(This description is provided by the company.)

Air Products is a leading industrial gases company with an 80-year history. It specializes in serving energy, environmental, and emerging markets by providing essential industrial gases, equipment, and expertise across various industries, including refining, chemicals, metals, electronics, manufacturing, and food and beverage. The company is also the global leader in liquefied natural gas technology and equipment. Notably, Air Products manages some of the world’s largest gasification projects, which convert natural resources into syngas for creating high-value power, fuels, and chemicals, among other innovative global energy solutions. Fiscal 2020 sales reached $8.9 billion, and the company now boasts a market capitalization of around $60 billion, with over 19,000 dedicated employees committed to environmental sustainability and innovative solutions.

Fintel is a comprehensive investing research platform available for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and more. Moreover, our exclusive stock picks leverage advanced quantitative models aimed at improving profitability.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.