Redburn Atlantic Issues Buy Recommendation on MercadoLibre

On October 11, 2024, Redburn Atlantic began coverage of MercadoLibre (XTRA:MLB1), giving the company a Buy recommendation.

Analyst Predictions Indicate 11.89% Growth Potential

As of September 25, 2024, the average price target for MercadoLibre over the next year stands at 2,094.53 €/share. Predictions range between a low of 1,637.96 € and a high of 2,525.86 €. This average target implies a potential increase of 11.89% from the latest closing price of 1,872.00 € per share.

Projected Revenue and Earnings

MercadoLibre’s anticipated annual revenue is 16,573MM, which represents a decrease of 3.13%. Additionally, the projected annual non-GAAP EPS is 24.60.

Investors’ Perspective

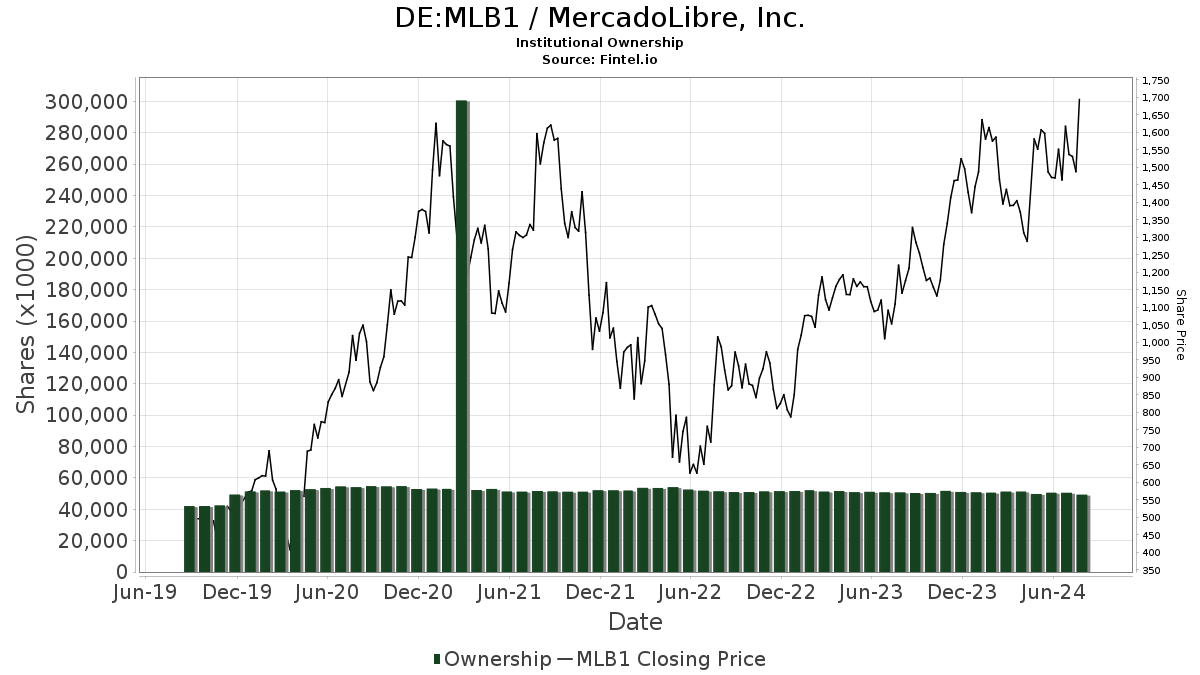

Currently, 2,006 funds and institutions hold positions in MercadoLibre, reflecting an increase of 57 owners, or 2.92%, compared to the previous quarter. The average portfolio weight of funds invested in MLB1 has risen to 0.91%, an increase of 1.85%. Over the past three months, total shares owned by institutions have grown by 4.74%, now totaling 50,801K shares.

Notable Institutional Investors

Baillie Gifford currently holds 4,846K shares, which accounts for 9.56% of the company. Previously, they had reported ownership of 5,037K shares, indicating a decrease of 3.93%. However, Baillie Gifford has increased its portfolio allocation in MLB1 by 4.74% since last quarter.

Capital Research Global Investors owns 2,331K shares, making up 4.60% of the company. Their prior stake was 2,360K shares, showing a decrease of 1.26%. Yet, they enhanced their portfolio allocation by 4.10% in the last quarter.

JPMorgan Chase owns 1,814K shares, representing 3.58% of the company. Previously, their stake was 2,077K shares—a decrease of 14.51%. Their portfolio allocation in MLB1 dropped by 7.82% during the last quarter.

Jennison Associates holds 1,804K shares, which is 3.56% of MercadoLibre. In their previous report, they owned 1,797K shares, indicating a slight increase of 0.35%. Their portfolio allocation increased by 4.56% last quarter.

The Vanguard International Growth Fund Investor Shares (VWIGX) has ownership of 1,289K shares, representing 2.54% of the company. This is down from their previous holding of 1,361K shares, marking a decrease of 5.58%, even as the firm managed to increase its portfolio allocation by 0.42% last quarter.

Fintel is known for its comprehensive investment research tools used by individual investors, traders, financial advisors, and small hedge funds. Our extensive global data includes financial fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading metrics, and much more, all tailored for enhanced decision-making.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.