Advanced Micro Devices: A Hidden Gem in Semiconductors

Investors may face challenges in gauging the valuation of Advanced Micro Devices (NASDAQ: AMD). Following a decline of about 50% in its market capitalization since last March, its trailing P/E ratio stands at a high 109, suggesting the stock might still be too expensive.

However, a closer examination could indicate that AMD is currently one of the most undervalued semiconductor stocks available, representing a potential opportunity for savvy investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Assessing AMD’s Value Proposition

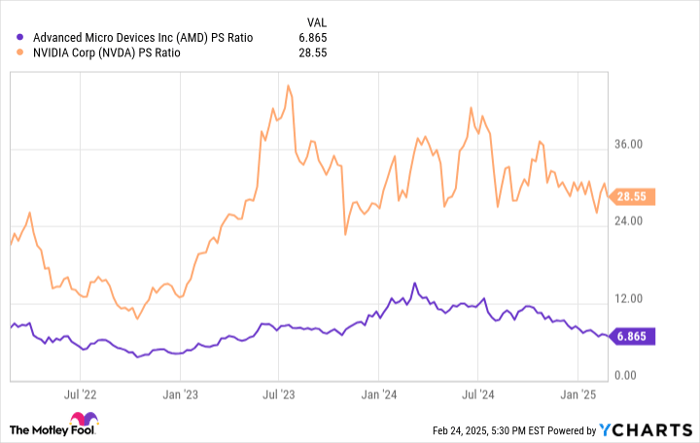

The true value of AMD becomes clearer when beyond its seemingly inflated trailing P/E ratio. It sports a forward P/E ratio of just 23, reflecting its growth potential, which marks a two-year low for that metric. Furthermore, when comparing price-to-sales (P/S) ratios, AMD’s sales multiple, approximately 7, is significantly lower than that of its rival, Nvidia. This comparison further suggests that the stock could be a worthwhile investment.

AMD PS Ratio data by YCharts.

While AMD has made strides in the CPU arena, it still trails in the GPU and AI accelerator markets. The underperformance in its gaming and embedded segments has negatively impacted both revenue growth and profit margins, contributing to a less favorable view of the stock among investors.

Despite these challenges, AMD has nearly halted revenue declines in its embedded operations. Additionally, the introduction of the DeepSeek AI model suggests that in the future, companies may develop, train, and run AI models at lower costs using less powerful hardware. This shift may enhance the attractiveness of AMD’s more affordable chips.

As these changes unfold, AMD’s financial performance has begun to rebound. In 2024, revenue rose by 14% to $26 billion, contrasting with a 4% decline in 2023. Moreover, net income increased to $1.6 billion from $854 million the previous year. These positive trends have decreased AMD’s P/E and P/S ratios, making the stock a more appealing buy at its current price point.

While it’s likely that Nvidia will continue to dominate the AI accelerator market, the valuation differences between these two semiconductor firms position AMD as a more attractive investment opportunity today.

Seize This Potentially Lucrative Opportunity

Do you sometimes feel like you missed the chance to invest in the most successful stocks? If so, you’ll want to pay attention to this situation.

In rare instances, our expert analysts issue a “Double Down” Stock recommendation for companies poised for a significant upward shift. If you’re concerned you’ve missed your opportunity, now might be the best time to invest before it’s too late. Consider these impressive returns:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $323,920!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $45,851!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $528,808!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, and this might be a singular opportunity.

Continue »

*Stock Advisor returns as of February 28, 2025

Will Healy holds positions in Advanced Micro Devices and Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia. The Motley Fool recommends initiating options: short February 2025 $27 calls on Intel. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.