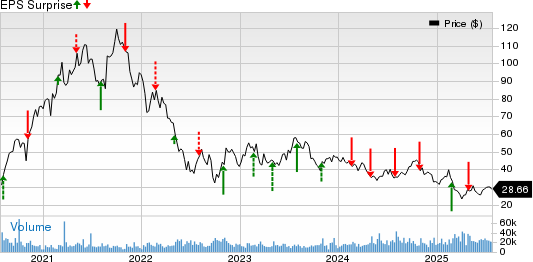

Regions Financial Corporation had a bit of a rollercoaster ride in the fourth quarter of 2023, with its adjusted earnings per share beating estimates but revenues experiencing a year-over-year decline. The bank’s adjusted EPS of 52 cents surpassed the Zacks Consensus Estimate of 48 cents, although it was lower than the 67 cents reported in the prior-year quarter. This performance hints at an upward trajectory, but it also raises questions about the bank’s long-term sustainability.

Revenues Fall, Expenses Rise

The bank witnessed total quarterly revenues of $1.81 billion, outperforming the Zacks Consensus Estimate of $1.80 billion. Despite surpassing expectations, the top line fell 9.5% from the year-ago quarter’s figure, indicative of potential challenges in revenue generation despite the beat.

Non-interest expenses rose by a significant 16.5% year over year to $1.19 billion, majorly influenced by FDIC special assessment fees and severance-related costs. This substantial rise in expenses could potentially signal broader challenges in cost management and operational efficiency within the organization.

Credit Quality Deteriorates

One concerning aspect was the deterioration in credit quality, as non-performing assets and non-performing loans increased compared to the previous year. Adjusted net charge-offs also saw a 10-basis point increase from the prior-year period, raising warning flags about the bank’s asset quality and risk management practices.

Capital Ratios Improve

It wasn’t all doom and gloom, as the bank’s Common Equity Tier 1 ratio and Tier 1 capital ratio both improved, signaling enhanced capital adequacy. This performance indicates the bank’s commitment to fortifying its balance sheet and navigating through uncertain financial terrain.

Our Viewpoint

While Regions Financial Corporation’s attractive core business and revenue-diversification strategies give hope for the future, the lack of diversification in its loan portfolio remains a headwind. Investors will be keenly observing how the bank addresses these challenges in the coming quarters.