May Lim/iStock via Getty Images

When will the sun shine on Real Estate Investment Trusts (REITs) again? Probably not anytime soon. It was an inauspicious end to the week, with REITs underperforming broader markets for the second consecutive week, ending lower in the absence of a positive catalyst.

Market Performance

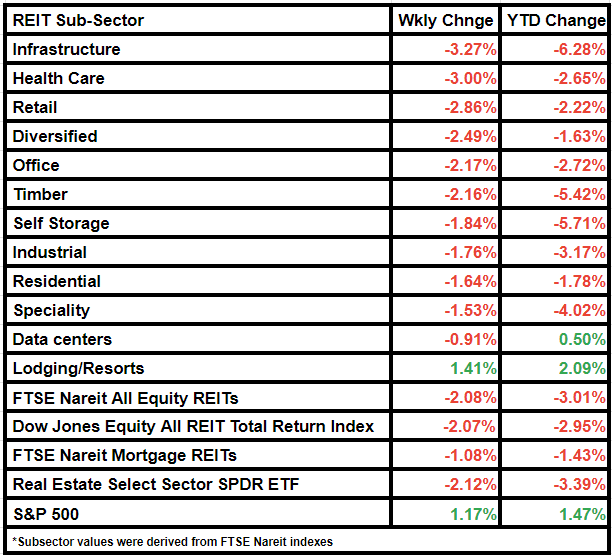

The FTSE Nareit All Equity REITs index fell by 2.08%, while the Dow Jones Equity All REIT Total Return Index suffered a 2.07% decline. FTSE NAREIT Mortgage REITs were also down, dropping by 1.08%. The broader Real Estate Select Sector SPDR ETF mirrored this downtrend, declining by 2.12%. Meanwhile, the S&P 500 managed to gain 1.17% during the same time frame.

Short Interest Decline

Despite the gloom, short interest on equity REITs continued to decline, registering an average short interest of 3.3% of the total float in December, as reported by S&P Global Market Intelligence. This figure was slightly higher at 3.6% in November.

Company Performance

The start of the earnings season for REITs failed to bring any cheer, as industrial REIT Prologis (PLD) missed the mark with its Q4 earnings, failing to exceed the average analyst estimate. Additionally, its 2024 guidance range indicated a potential fall short of the Wall Street consensus. Looking ahead, Mortgage REIT AGNC Investment (AGNC) is also expected to post a decline in Q4 earnings next week.

Subsector Performance

Not all was misery though, as the rental housing segment managed to eke out some gains on the positive announcement of the Blackstone-Tricon Residential deal. However, the residential subsector still fell by 1.64% over the course of the week. Infrastructure witnessed the steepest decline at 3.27%, followed closely by Health Care at 3.00%. Lodging/Resorts stood out with a gain of 1.41% for the week, buoyed in part by strong December results from major hotel REIT, Pebblebrook Hotel Trust (PEB). The latter is optimistic about the Q4 adjusted FFO per share beating its prior outlook.

Top Performers and Laggards

Power REIT (PW) was a significant laggard, shedding approximately 13% in value over the week. Conversely, Net Lease Office Properties (NLOP) emerged as the biggest gainer, soaring by about 22% from the previous week.

Overall, a tough week for REITs, with bleak performances across various sectors. Investors must wonder when the tide will turn in favor of these realty investments.

Here is a look at the subsector performance for the week: