Funtap

The start of the year has not been favorable to Real Estate Investment Trusts (REITs) as the market grapples with the prospect of a rate cut. The FTSE Nareit All Equity REITs index experienced a 1.59% decline in the week ended Jan. 5, while the Dow Jones Equity All REIT Total Return Index was down 1.57%.

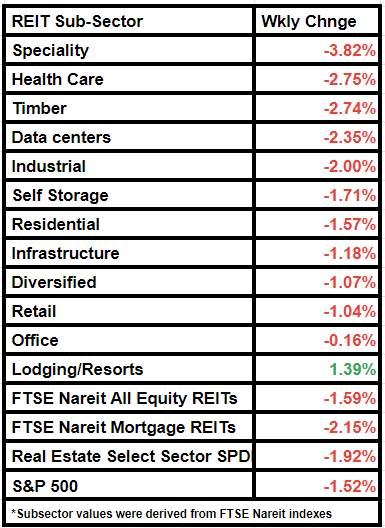

Equity REITs struggled to keep pace with the broader markets, with the S&P 500 declining by 1.52% in comparison. Furthermore, the Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) fell by 1.92%, while mortgage REITs decreased by 2.15% from the previous week.

The decline in XLRE was particularly sharp, reflecting growing skepticism about the likelihood of near-term rate cuts. In a stark contrast to the end of 2023, where futures were pricing in a Federal Reserve rate cut by March, the probability has now been revised to 85%, as per comments from Deutsche Bank’s Jim Reid.

Notably, mortgage rates increased marginally for the first time since October 2023, according to the Freddie Mac Primary Mortgage Survey. Additionally, mortgage demand dipped by 10.7% this week, according to the Mortgage Bankers Association.

Among the REITs, Medical Properties Trust (MPW) experienced significant losses as it traded at its lowest level since 2009. The decline was attributed to the company’s measures to recover uncollected rents from troubled tenant Steward Health Care System.

Office REIT Peakstone Realty Trust (PKST) was another significant underperformer during the week.

Within the subsectors, the Speciality subsector saw the largest decline at 3.82%, closely followed by a 2.75% drop in the Health Care subsector.

However, in a surprising turn of events, Hotel REITs emerged as major outliers, gaining 1.39% on a weekly basis.