Throughout the week, REITs showed a commendable performance, albeit falling short in comparison to the broader market. The FTSE Nareit All Equity REITs index recorded a gain of 0.66%, while the Dow Jones Equity All REIT Total Return Index experienced an upsurge of 0.70%. In contrast, the S&P 500 observed a more substantial increase of 1.84% over the same period.

These figures were influenced by a variety of macro-level factors that instilled a sense of hope and promise among investors.

The broader market’s positive trend can be partially attributed to a decrease in producer price inflation by 0.1% in December, contrary to the anticipated 0.1% rise. Additionally, the Q4 earnings season commenced on a positive note, with the five major banks collectively generating almost $66B in net interest income. This is a remarkable feat considering the prevailing backdrop of the highest interest rates witnessed in 23 years.

Meanwhile, the Real Estate Select Sector SPDR ETF reported an increase of 0.64%, and the mortgage REITs index surged by 1.83%.

Despite the overall positive trend, the Office REITs subsector experienced a 0.40% decline compared to the previous week. Interestingly, the most significant movements within the REIT space were witnessed in this particular category, with Net Lease Office Properties (NYSE:NLOP) gaining nearly 28% week-over-week, emerging as the top gainer. Conversely, Office Properties Income Trust (NASDAQ:OPI) suffered a decline of approximately 45%, making it the most significant underperformer.

While the risk profile of Office REITs remains relatively consistent, market sentiment towards this subsector has notably shifted. Although investing in this category still holds appeal, the allure has waned, and valuations have become less compelling, as per insights from Seeking Alpha contributor Wolfe Report.

Other prominent gainers for the week included UMH Properties (NYSE:UMH) and Generation Income Properties (NASDAQ:GIPR), while Wheeler Real Estate Investment Trust (NASDAQ:WHLR) experienced a decline of approximately 22%, positioning it among the week’s significant laggards.

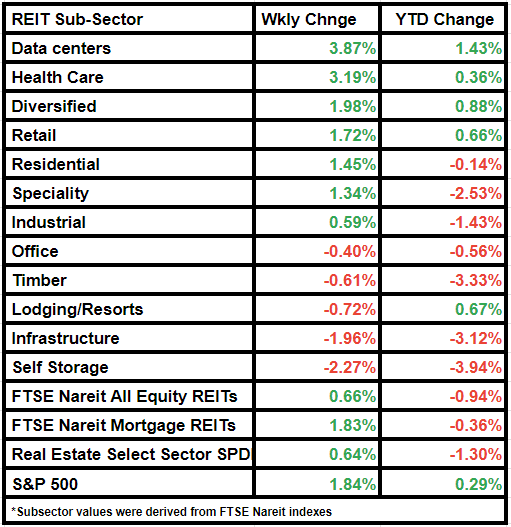

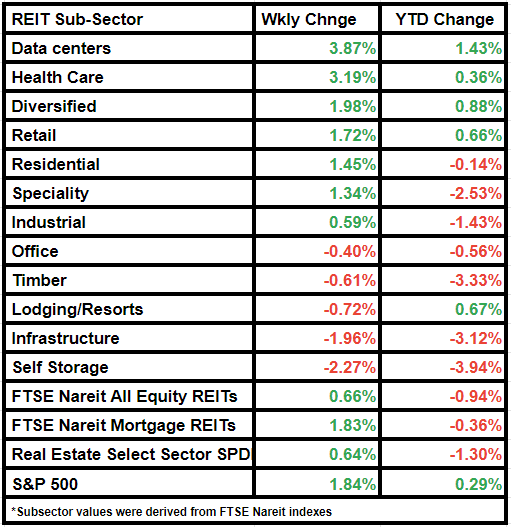

Unveiling the performance across subsectors, Self Storage witnessed the most substantial decline of 2.27%, trailed by a 1.96% decrease for Infrastructure REITs.

On the flip side, Data centers and Health Care emerged victorious among subsectors, both securing a commendable surge of over 3% through the week. Diversified REITs also enjoyed notable gains, averaging at 1.98%.

For a detailed breakdown of the subsector performance last week, refer to the infographic below:

Exploring the Real Estate Sector Further