A Dive into the World of RSI

The oracle of Omaha, Warren Buffett, speaks of fear and greed in the stock market. Investors often take cues from the Relative Strength Index (RSI), a technical analysis tool gauging stock momentum on a scale of zero to 100. A stock becomes oversold when the RSI dips below 30.

BRZE Takes a Dive

On Thursday, Braze Inc (Symbol: BRZE) found itself in oversold territory with an RSI of 28.4, exchanging hands as low as $42.49 per share. For context, the RSI of the S&P 500 ETF (SPY) stands at 66.1. A savvy investor might interpret BRZE’s RSI as a signal that the recent selling frenzy is tapering off, hinting at potential buying opportunities.

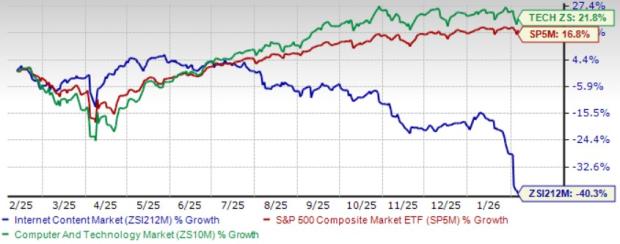

The one-year performance chart of BRZE paints a vivid picture. The stock’s annual range spans from a low of $25.76 per share to a high of $61.53, with the last trade settling at $45.66.

![]() Find out what 9 other oversold stocks you need to know about »

Find out what 9 other oversold stocks you need to know about »

Further Insights:

Unveiling Construction Dividend Stock List

Analyzing COST RSI

Deciphering Top Ten Hedge Funds Holding WTRH

The sentiments conveyed here are those of the author and may not align with Nasdaq, Inc.’s views.